In an effort to revive the country's auto sector, China's State Council announced on September 30th that the sales tax on the purchase of vehicles with engine capacity of less than 1.6 liters (i.e. most passenger cars) would be halved, from 10% to 5%. This reduction took effect on October 1st, and will remain through to the end of 2016. The move may seem minor, but it has important economic and policy implications worth recognizing in the broader China context, according to Scotiabank.

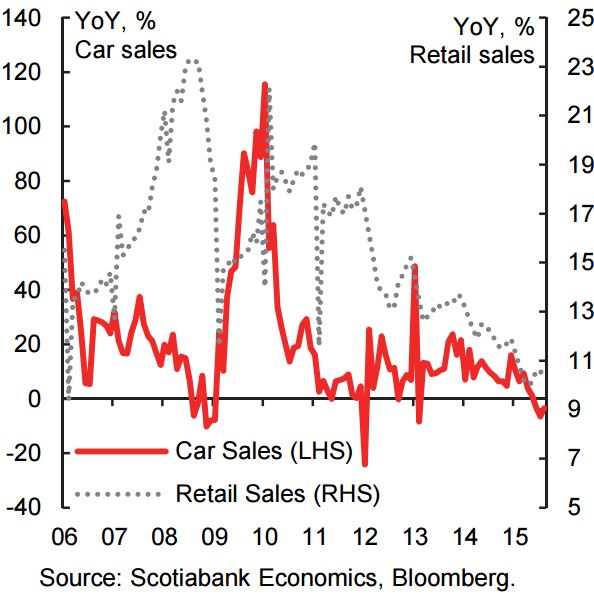

China's auto industry has experienced rapid growth over the past decade, with sales volumes surpassing the United States in 2009 to become the world's largest auto market. Car purchases year-to-date remain on a record-setting pace and we forecast annual sales, including SUVs, will reach 19 million by the end of 2015. However, more recently, concerns about the sector have risen as the momentum behind purchases and output has moderated. Passenger car purchases y/y fell into negative territory in June of this year and were at -3.4% y/y in August. While it's true that most economic activity indicators have softened this year, car sales have been particularly weak in recent months, substantially underperforming overall retail sales growth of +10.8% y/y.

The tax cut may initially appear to be a narrow fiscal target, but our sense is that the move is intended to stimulate broader economic growth. It also highlights the importance of the auto industry to the Chinese economy. We estimate that auto sales and production account for more than 10% of the economy. More than 70% of all passenger vehicles sold in China have engine capacity of less than 1.6 liters, so the tax cut is well targeted to hit the majority of the sector. From a demand-side perspective, there is plenty of capacity for the industry to grow domestically: the G7 average car ownership rate currently runs at 689 per 1,000 people, while China currently has only 104 cars per 1,000 people. From a supply-side perspective, vehicle sales have increased at a double-digit pace over the past decade and automakers continue to add capacity in China, leading to the risk of significant excess capacity if sales stall for an extended period.

History also suggests that car sales will improve following a tax cut. In January of 2009, China similarly halved the sales tax on passenger cars from 10% to 5% to bolster a weak market. Sales immediately jumped 19% m/m, and vehicle sales turned from a negative year-over-year performance in the final months in 2008 to full-year growth of 53% in 2009. While the impact will likely be more subdued in this slower growth environment, we expect the tax cut to help support the purchase of at least an additional one million vehicles.

From a policy perspective, the tax cut is significant for three reasons. First, the move emphasizes policymakers' ongoing focus on the auto sector as a key driver of growth and employment. Last month, the PBOC cut the required reserves ratio (RRR) for auto-financing firms by 350 bps, much more than the 50bps cut for banks. Second, the tax cut is an example of policymakers relying more directly on fiscal stimulus to bolster growth, consistent with their goals of deleveraging. Moreover, the expiry date on the stimulus, valid only until December 2016, is clearly intended to create an immediate jumpstart to growth. Third, the move signals increased emphasis on the consumer as the next driver of growth, targeting underlying demand as opposed to, for example, cutting the RRR for financing firms, a supply-side maneuver.

China’s auto sales tax cut is a key economic and policy move worth monitoring

Sunday, October 11, 2015 11:23 AM UTC

Editor's Picks

- Market Data

Most Popular

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off