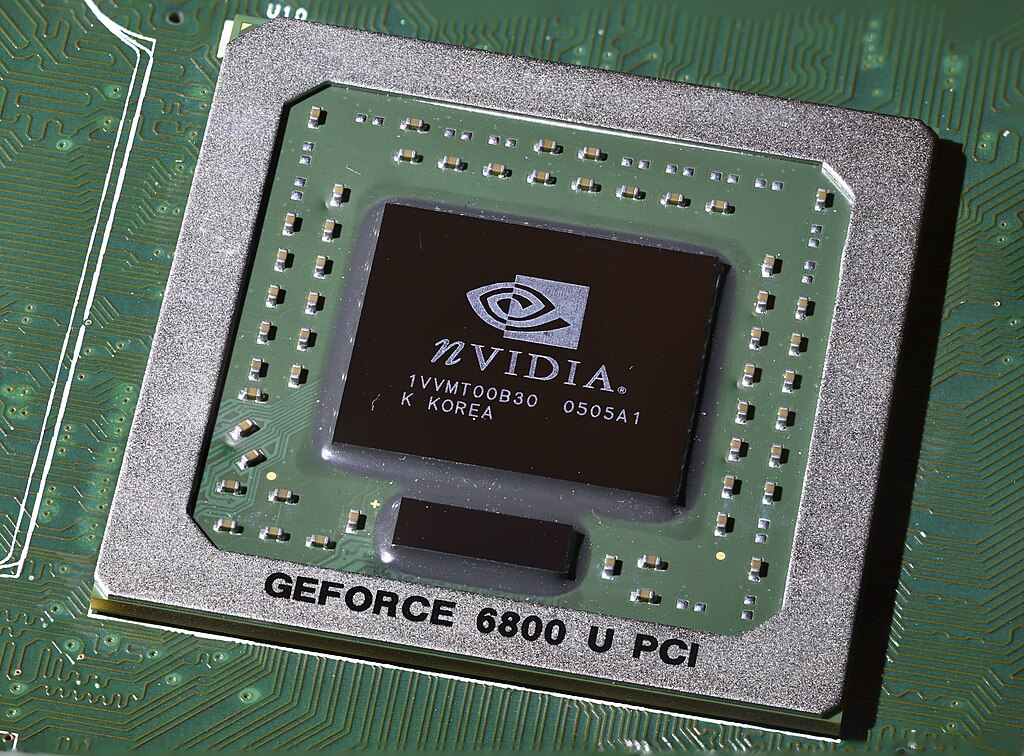

Demand in China is soaring for the repair of banned Nvidia (NASDAQ: NVDA) artificial intelligence chipsets, including H100 and A100 GPUs, despite U.S. export restrictions aimed at curbing Chinese technological and military advancements. Around a dozen boutique firms in Shenzhen now specialize in repairing these high-end GPUs, which continue to enter China through smuggling channels.

The H100, prohibited from sale to China since September 2022, remains highly sought after for training large language models, outperforming locally developed alternatives such as Huawei’s AI chips. Repair companies report servicing up to 500 GPUs monthly, offering diagnostics, memory and PCB repairs, and testing in data center-like environments. Costs typically range from 10,000 to 20,000 yuan ($1,400–$2,800) per chip.

The booming repair industry highlights China’s ongoing reliance on U.S. technology, even as Nvidia introduces the H20 chipset designed to meet export compliance. However, the H20’s higher price and reduced performance for AI training limit its appeal. Servers equipped with eight H20 GPUs can exceed 1 million yuan ($139,000), while newer B200 GPUs, now entering global markets, fetch more than 3 million yuan in China.

U.S. lawmakers are responding to the rise in unauthorized Nvidia chip use with proposals to track GPU locations post-sale. Nvidia itself warns that unauthorized repairs compromise technical performance and support, as the company cannot legally service restricted products in China.

Industry experts expect demand for repairs to persist as older AI GPUs run continuously, with many approaching their two-to-five-year lifespan. The ongoing smuggling and repair market underscores the intense global competition for advanced AI hardware and China’s determination to sustain its AI development despite sanctions.

Instagram Outage Disrupts Thousands of U.S. Users

Instagram Outage Disrupts Thousands of U.S. Users  SpaceX Reports $8 Billion Profit as IPO Plans and Starlink Growth Fuel Valuation Buzz

SpaceX Reports $8 Billion Profit as IPO Plans and Starlink Growth Fuel Valuation Buzz  SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off  SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates

SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates  Anthropic Eyes $350 Billion Valuation as AI Funding and Share Sale Accelerate

Anthropic Eyes $350 Billion Valuation as AI Funding and Share Sale Accelerate  Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine

Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine  Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports

Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports  AMD Shares Slide Despite Earnings Beat as Cautious Revenue Outlook Weighs on Stock

AMD Shares Slide Despite Earnings Beat as Cautious Revenue Outlook Weighs on Stock  Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch

Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch  Elon Musk’s SpaceX Acquires xAI in Historic Deal Uniting Space and Artificial Intelligence

Elon Musk’s SpaceX Acquires xAI in Historic Deal Uniting Space and Artificial Intelligence  Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit

Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit  Sam Altman Reaffirms OpenAI’s Long-Term Commitment to NVIDIA Amid Chip Report

Sam Altman Reaffirms OpenAI’s Long-Term Commitment to NVIDIA Amid Chip Report  TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment  Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge