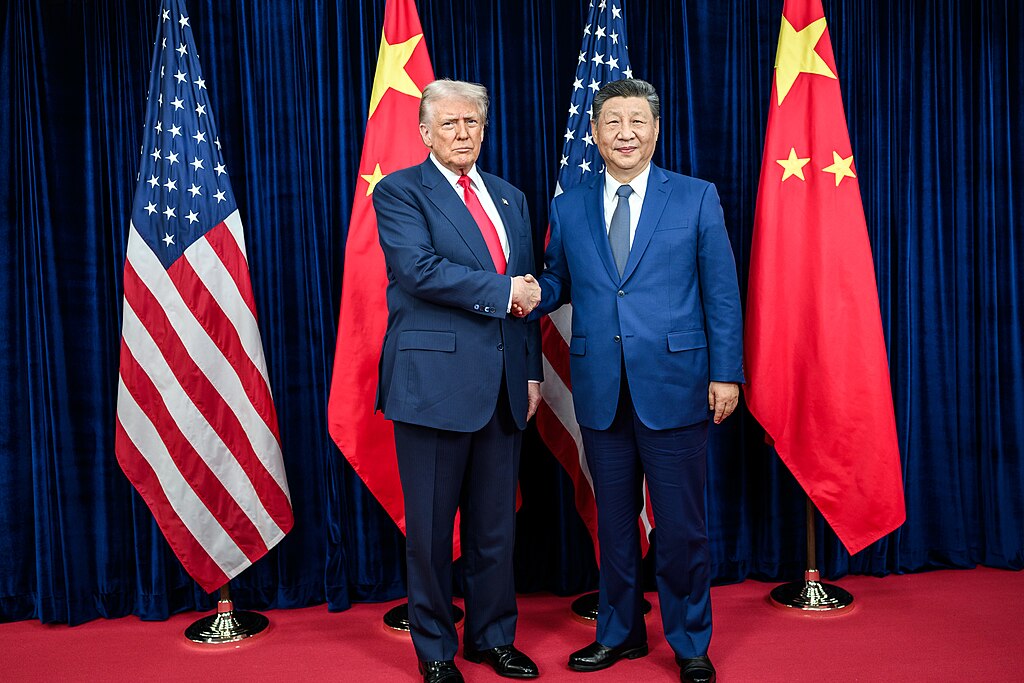

China confirmed it will suspend retaliatory tariffs on select U.S. imports following last week’s meeting between President Donald Trump and Chinese President Xi Jinping. Starting November 10, Beijing will remove duties of up to 15% on certain American agricultural goods but maintain a 10% levy introduced earlier, along with a 13% tariff on U.S. soybeans.

The move signals progress in easing trade tensions between the world’s two largest economies after years of tariff disputes that disrupted global supply chains. Analysts say the decision shows both sides are committed to implementing their recent trade understandings.

U.S. soybean futures surged to their highest level since June 2024 amid hopes for renewed Chinese demand. However, the continued 13% tariff keeps American soybeans less competitive compared to Brazilian supplies. With Brazilian beans priced over $1 cheaper per bushel, traders expect limited Chinese purchases from the United States unless Beijing fully waives the duty.

Despite the tariff, the White House announced China’s intention to buy at least 12 million metric tons of U.S. soybeans by year-end and 25 million tons annually over the next three years. China has yet to confirm these commitments. Analysts suggest state grain buyer Sinograin may handle most purchases, as it operates outside commercial constraints and contributes to national reserves.

Before the leaders’ meeting, state-owned trader COFCO made symbolic U.S. soybean purchases from the 2025 harvest, signaling goodwill. In 2024, the U.S. accounted for just 20% of China’s soybean imports—down from 41% in 2016.

China’s cabinet also announced a one-year suspension of an additional 24% tariff on certain U.S. goods and the temporary removal of non-tariff measures imposed earlier this year. The decision highlights cautious optimism for improved U.S.-China trade relations while global markets await concrete signs of large-scale agricultural purchases.

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  US Pushes Ukraine-Russia Peace Talks Before Summer Amid Escalating Attacks

US Pushes Ukraine-Russia Peace Talks Before Summer Amid Escalating Attacks  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Trump Allows Commercial Fishing in Protected New England Waters

Trump Allows Commercial Fishing in Protected New England Waters  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Netanyahu to Meet Trump in Washington as Iran Nuclear Talks Intensify

Netanyahu to Meet Trump in Washington as Iran Nuclear Talks Intensify  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Japan Election 2026: Sanae Takaichi Poised for Landslide Win Despite Record Snowfall

Japan Election 2026: Sanae Takaichi Poised for Landslide Win Despite Record Snowfall  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Norway Opens Corruption Probe Into Former PM and Nobel Committee Chair Thorbjoern Jagland Over Epstein Links

Norway Opens Corruption Probe Into Former PM and Nobel Committee Chair Thorbjoern Jagland Over Epstein Links  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Pentagon Ends Military Education Programs With Harvard University

Pentagon Ends Military Education Programs With Harvard University  China Warns US Arms Sales to Taiwan Could Disrupt Trump’s Planned Visit

China Warns US Arms Sales to Taiwan Could Disrupt Trump’s Planned Visit  Ohio Man Indicted for Alleged Threat Against Vice President JD Vance, Faces Additional Federal Charges

Ohio Man Indicted for Alleged Threat Against Vice President JD Vance, Faces Additional Federal Charges  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength