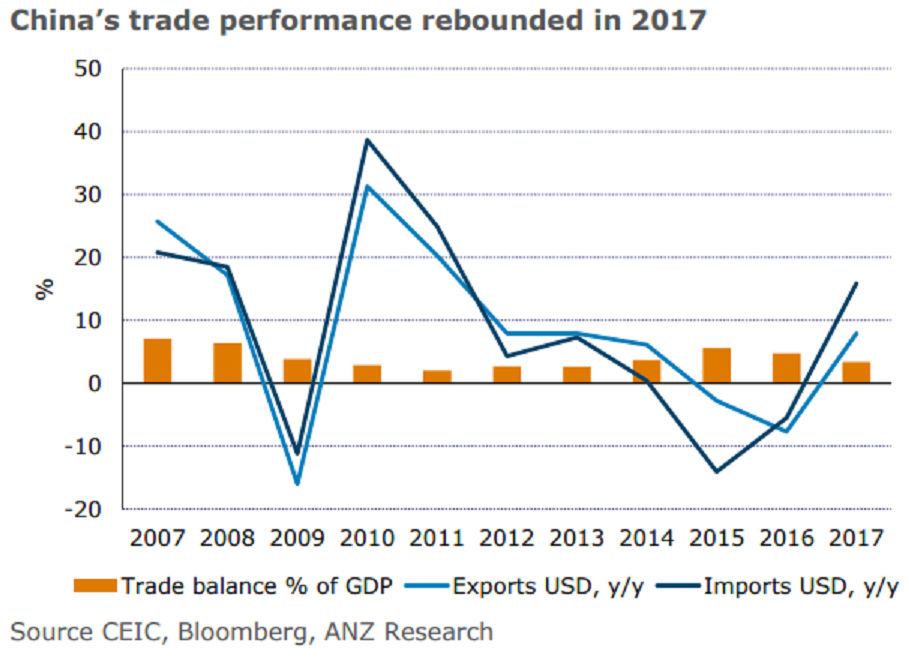

China’s trade outperformed in 2017, ending two years’ contraction, thanks to recovering demand both domestically and abroad. Exports (in USD) grew 7.9 percent y/y in 2017, with exports to major markets including US, EU, and ASEAN up 11.3 percent y/y, 9.1 percent y/y and 7.0 percent y/y (compared with declines across the board in 2016). Imports rose 15.9 percent y/y in 2017, supported by a rebound in domestic demand and higher import commodity prices.

The latter contributed more than half of the headline import growth, according to China Customs. As a result, the trade surplus narrowed to USD422.5 billion (or 3.4 percent of GDP) in 2017 from USD509.7 (4.8 percent of GDP) in 2016.

With a much better trade performance and a steady outlook, concerns about the impact of FX policy on China’s exports may take a back seat. This, together with stable capital outflows and a rising trend in FX reserves, indicates a possibility of further loosening in FX policy in 2018. China’s recent release of promoting cross-border settlements in RMB and adjustment in the daily yuan fixing mechanism is moving towards this direction.

"Uncertainty surrounding Sino-US trade ties might be a key potential downside risk in the near term. While we remain comfortable about China’s export outlook for 2018, there are still uncertainties about Sino-US trade ties which may suddenly erupt," ANZ Research commented in its latest report.

Meanwhile, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran