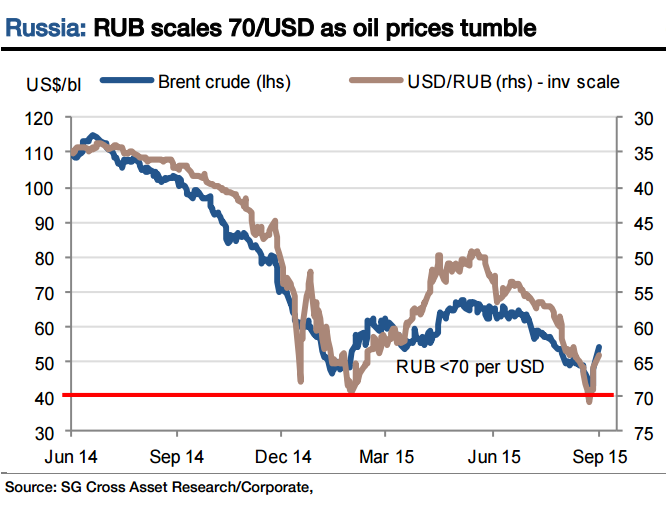

Global risk aversion and the fall in oil prices have pushed the RUB below 70 per USD. The possibility of a rate hike by the CBR is not ruled out and this has prompted to initiate a 1y cross-currency payer trade at 13.05% targeting a move higher to 16.00%. Corporate borrowers hurt by sanctions face additional burden of $61bn of foreign debt repayments over the next four months (USD buying needs).

The CBR has offered loans to help lighten the cost, alleviating pressure on the RUB. The economy contracted 4.6% yoy in Q2, July CPI edged up to 15.6% from 15.3%. A recent Bloomberg survey shows: 63% of economists expect the CBR will intervene if oil prices fall below $40pbl while 47% see an emergency rate increase.

Central bank of Russia on alert to counter market instability

Thursday, September 3, 2015 8:18 PM UTC

Editor's Picks

- Market Data

Most Popular

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal