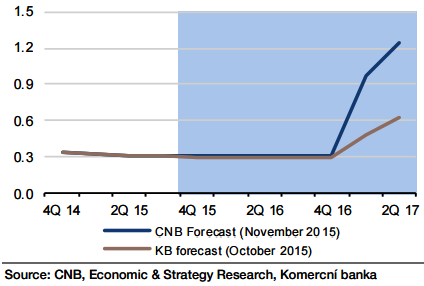

The CNB's interest rate forecast points to four 25bp hikes in the first half of the 2017. However, CNB would likely exit the intervention regime earlier and hike less.

"Given the market outlook on ECB rates, the ECB deposit rate should be -0.3% at that moment. The CNB's interest rate differential would attract more capital inflow into CZK, creating appreciation pressure", says Societe Generale in a research note.

Czech's inflation rate is rising and hitting its inflationary target at monetary policy horizon, there is strong consumer demand and solid GDP growth. The central bank's projected interest rate path seems excessive, taking these factors into consideration.

"There will also be a board reshuffle in Q3 16, and the president will likely appoint two new board members who oppose the intervention policy. Despite the change in CNB language, we do not see any reason to change our view that the floor will be scrapped in Q3 16", added Societe Generale.

The Czech National Bank's interest rate outlook likely to create appreciation pressure on CZK

Friday, November 6, 2015 7:19 AM UTC

Editor's Picks

- Market Data

Most Popular

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell