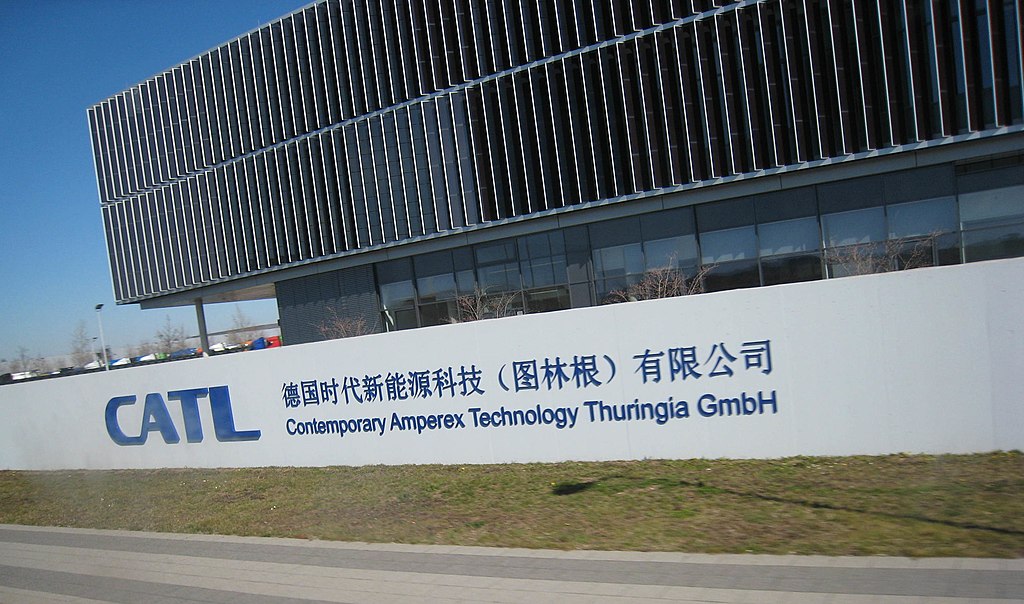

Chinese battery giant Contemporary Amperex Technology Co. Ltd. (CATL) is preparing for a major Hong Kong listing to raise approximately $5 billion, potentially marking the city’s largest new share sale in four years. According to three sources familiar with the matter, the offering price is expected to be set at a discount of less than 10% compared to CATL’s Shenzhen-listed shares, with two indicating a mid-single-digit percentage discount.

CATL is currently engaging with institutional investors ahead of next week’s book building phase. The company is seeking cornerstone and anchor investors to purchase about half of the shares in the offering, a strategy often used to boost confidence in large-scale IPOs.

The pricing of the deal has not yet been finalized, and CATL has not issued an official comment. The sources requested anonymity as the details are not yet public.

This Hong Kong secondary listing comes amid growing global demand for electric vehicle (EV) batteries and heightened interest in China’s new energy sector. CATL, a key battery supplier for major automakers like Tesla and BMW, aims to leverage the capital raised to expand production and strengthen its global footprint.

The anticipated listing also reflects a broader trend of Chinese firms seeking to tap offshore capital markets amid domestic regulatory shifts. CATL’s move could help revive investor appetite in Hong Kong's equity market, which has seen subdued IPO activity in recent years.

The company showcased its latest technologies at the Auto China 2024 event in Beijing, underscoring its innovation and leadership in lithium-ion battery development. As one of the world's largest EV battery manufacturers, CATL’s Hong Kong listing is poised to attract significant global investor interest.

Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape

Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape  Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks

Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks  Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links  CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences

CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences  TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment  Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains

Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains  SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO

SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO  FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns

FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns  Ford and Geely Explore Strategic Manufacturing Partnership in Europe

Ford and Geely Explore Strategic Manufacturing Partnership in Europe  Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million

Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million  American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns

American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns  Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Instagram Outage Disrupts Thousands of U.S. Users

Instagram Outage Disrupts Thousands of U.S. Users  Washington Post Publisher Will Lewis Steps Down After Layoffs

Washington Post Publisher Will Lewis Steps Down After Layoffs  Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch

Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch  SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates

SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates