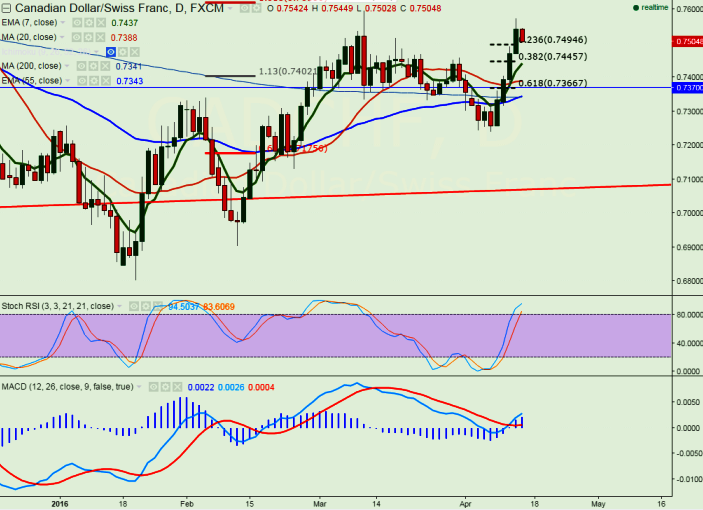

- Major resistance – 0.7600

- Major support - 0.7400 (55 day 4H EMA)

- CAD/CHF has made a temporary top around 0.75744 and started to decline from that level. It is currently trading around 0.75098.

- Short term trend is slightly weak as long as resistance 0.7600 holds.

- On the lower side minor support is around 0.7495 (23.6% retracement of 0.7240 and 0.75744) and break below will take the pair to next level till 0.7450/0.7400 level.

- Minor trend reversal only below 0.7400 level.

- On the higher side any break above 0.7600 confirms minor bullishness, a jump till 0.7620/0.7660/0.7700 is possible.

It is good to sell on rallies around 0.7515-20 with SL around 0.7575 for the TP of 0.7455/0.7405

R1-0.7600

R2-0.7660

R3-0.7700

Support

S1-0.7495

S2-0.7450

S3-0.7400