In its latest move to spur business investment, the government will extend its $150,000 instant assets write-off until the end of the year.

The six-months extension, which will be legislated, will cost $300 million in revenue over the forward estimates.

As part of the government’s pandemic emergency measures, in March it announced that until June 30 the write-off threshold would be $150,000 and the size of businesses eligible would be those with turnovers of under $500 million.

The government is battling a major investment slump. Bureau of Statistics capital expenditure figures show non-mining investment fell 23% in the March quarter and 9% over the year to March.

Spending on plant and equipment fell 21%, spending on buildings and equipment plunged 25%.

An extra six months

Apart from giving businesses generally more time to claim the write-off, the government says the extension will help those which have been hit by supply chain delays caused by the pandemic.

The write-off helps businesses’ cash flow by bringing forward tax deductions. The $150,000 applies to individual assets – new or secondhand - therefore a single enterprise can write off a number of assets under the concession.

With rain breaking the drought in many areas, farm businesses are getting back into production, so the government will hope the extension will encourage spending on agricultural equipment.

About 3.5 million businesses are eligible under the scheme.

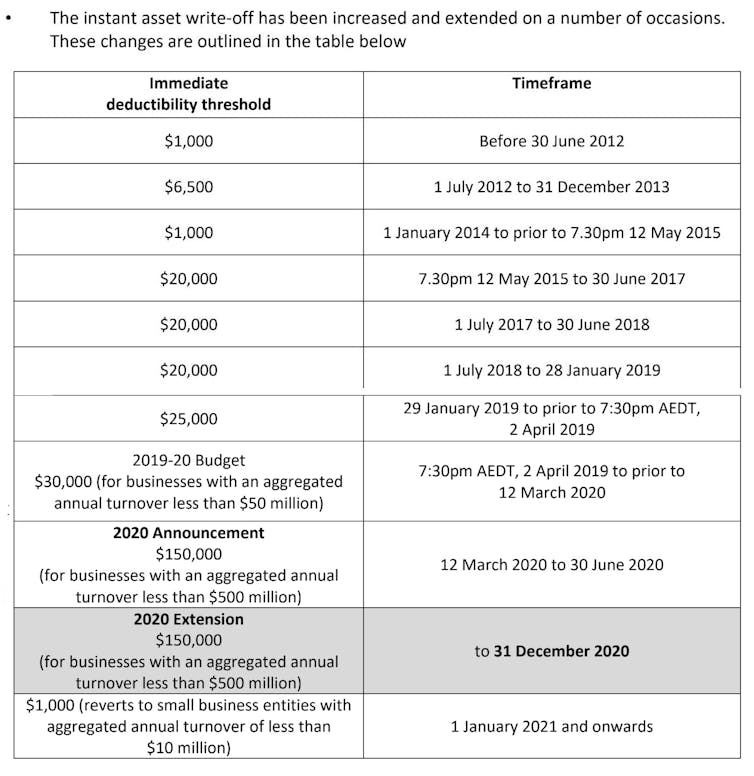

The instant asset write-off has been extended a number of times over the years, and its (much more modest) thresholds altered.

On the government’s revised timetable, from January 1 the write-off is due to be scaled down dramatically, reducing to a threshold of $1000 and with eligibility being confined to small businesses – those with an annual turnover of below $10 million.

But there will be pressure to continue with more generous arrangements, to head off the danger of a fresh collapse in investment.

In a statement, treasurer Josh Frydenberg and small business minister Michaelia Cash said the government’s actions “are designed to support business sticking with investment they had planned, and encourage them to bring investment forward to support economic growth over the near term”.

Commonwealth Government

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links  Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies

Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates

SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Ford and Geely Explore Strategic Manufacturing Partnership in Europe

Ford and Geely Explore Strategic Manufacturing Partnership in Europe  Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains

Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains  Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge  Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch

Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch  Australian Scandium Project Backed by Richard Friedland Poised to Support U.S. Critical Minerals Stockpile

Australian Scandium Project Backed by Richard Friedland Poised to Support U.S. Critical Minerals Stockpile  Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns

Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns  CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences

CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences  Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports

Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility