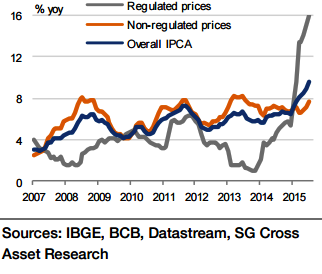

Releases through mid-August show that Brazil inflation continued to accelerate in Q3 despite signs that price adjustments in regulated spending categories are nearly over. In fact, two such key categories, housing and transportation, saw declines in mom inflation (compared with mom inflation during the same period last year) through mid-August.

YoY inflation, however, rose in seven of the nine categories, including significant acceleration in food prices and personal expenses. Based on IPCA-15, IPC-10 and IPC-market indices, full-month IPCA inflation likely accelerated to 9.71% yoy (0.39% mom) in August.

The bulk of the upside surprises over the past few months have been driven by a higher-thanexpected rise in food prices, although inflation also accelerated in the housing and transportation segments until a month ago. With the BRL depreciating heavily and a lagged impact expected in several price categories, the upside risk to the medium-term inflation outlook has been rising.

"Full-year inflation is forecasted at 9.0% followed by substantial, yet less than desirable, moderation in 2016 (6.5%) primarily due to the base effect. While theeffect of slow growth and the labour market deterioration could lead to a faster-than-expected slowdown in inflation next year, both the current trajectory and recent history give little confidence in this regard. Inflation will likely remain above the BCB's target over the forecast horizon", says Societe Generale.

Brazil inflation still accelerating, with upside risk to medium-term outlook

Tuesday, September 8, 2015 5:14 AM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX