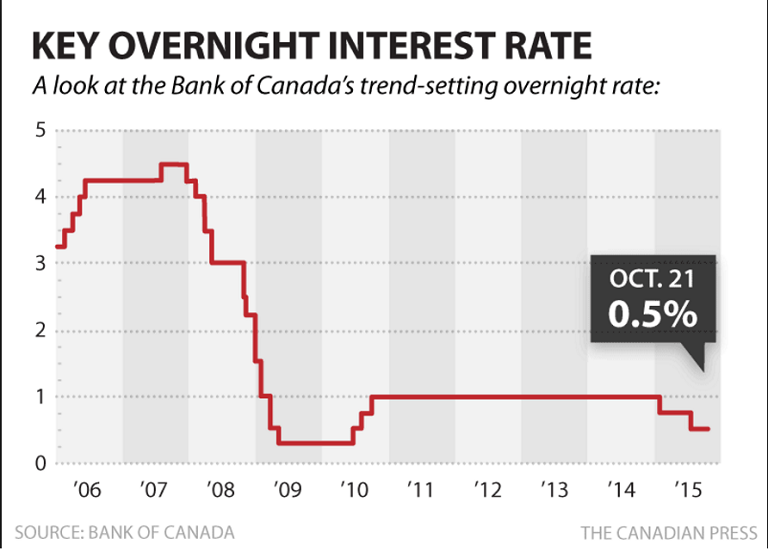

The Bank of Canada maintained overnight rate at 1/2 percent on Wednesday as widely expected. Even before the landslide sweep of the Liberal Party the Bank was widely expected to stand pat for the foreseeable future. The Liberals won on the platform of running budget deficits over the next three years, assuring a more stimulus next year to boost economic growth.

Canada's economy has been languishing despite repeated reductions in interest rates. BoC now estimates third quarter growth to have been roughly 2.5 percent with a slowdown to 1.5 percent growth in the current quarter. This would put this year's real GDP growth at a mere 1.1 percent--well below the 2.4 percent pace last year. The Bank has revised down its forecast of global growth in 2016 and 2017.

Total CPI inflation remains near the bottom of the Bank's target range, in line with the outlook in the Bank's July Monetary Policy Report. The Bank judges that the underlying trend in inflation continues to be about 1.5 to 1.7 per cent. The economy has rebounded, as projected in July. In non-resource sectors, the signs of strength are more evident, supported by the stimulative effects of previous monetary policy actions and past depreciation of the Canadian dollar.

Meanwhile, household spending continues to underpin economic activity and is expected to grow at a moderate pace over the projection period. As financial vulnerabilities in the household sector continue to edge higher, risks to financial stability are evolving as expected. Taking all of these developments into consideration, the Bank judges that the current stance of monetary policy remains appropriate.

BoC has run out of bullets with overnight interest rates so close to the zero and lower bound. The Bank will stand pat for at least the next year regardless of U.S. Federal Reserve action. The Fed is widely expected to start liftoff in the next few months.

The Canadian dollar steadies after slipping overnight on reduced BOC growth expectations. Weaker oil prices also weighed on the Canadian dollar. It dropped more than 1 percent against its U.S. counterpart after the Bank of Canada held its key rate steady as expected and also hinted that any hikes would be in the distant future. USD/CAD is trading at 1.3118 as of 0909 GMT.

BoC likely to stand pat for the next year regardless of Fed action

Thursday, October 22, 2015 9:31 AM UTC

Editor's Picks

- Market Data

Most Popular

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand