Stocks have held up relatively well during the COVID-19 pandemic. Following a steep decline in March, for example, the value of the Australian Stock has rebounded to be just 16% down on its February peak.

It’s a situation that appears to be exciting retail investors – regular people like you and I who buy shares directly. But this enthusiasm may be misplaced given the considerable uncertainty about the outlook for the economy.

We’ve analysed the trading in S&P/ASX 300 stocks from January to May 2020 to get a better understanding of what retail investors are doing.

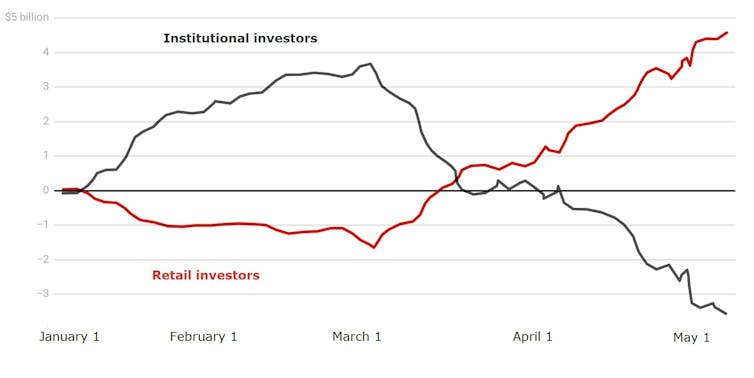

Between March 23 (when the stock market started rising) and May 2, retail investors were net buyers of A$3.57 billion. At the same time the “professional” institutional investors – including super funds – were net sellers of $3.27 billion.

Cumulative net buying (A$ billion)

S&P/ASX 300, January to mid-May 2020. Author's calculations

Notably, our results show retail investors weren’t just buying relatively safe “blue chip” stocks but also high-risk stocks.

Retail investors rush in

We decided to drill into the trading data after reports of booming retail investor activity. For example, an Australian Securities and Investments Commission analysis of trading between February 24 and April 3 found daily trading by retail brokers was double that of the preceding six months (A$3.3 billion compared with A$1.6 billion), and the rate of new trading accounts being opened increased 3.4 times.

Our analysis shows that from the start of the year to March 3 retail investors were net sellers, offloading about A$1.64 billion in stock. Between March 3 and May 8 they became net buyers of stock, accumulating A$6.29 billion in stock.

In contrast, institutional investors were net buyers through to March 3 (buying about A$3.73 billion of stock) but then net sellers, shedding A$7.3 billion worth of equities by May 8.

Daily average trading activity (both buying and selling) by retail investors between March and May was double the average for 2019 (of A$1.12 billion, compared with $A590 million). The daily average trading by institutional investors was 30% higher (A$12.26 billion a day, compared with A$8.67 billion over 2019).

What retail investors are buying

We examined stock buying based on four characteristics:

-

market capitalisation - the market valuation of a company based on its stock price and number of shares

-

the volatility of a stock price (how much it moves up or down) compared with the market average

-

level of debt, known as “leverage”. Companies with higher debt tend to be riskier investments in uncertain economic conditions

-

recent price changes – whether stock prices were rising or falling before our focus period.

Our analysis shows retail investors were net buyers not only of large-cap companies such as BHP and Commonwealth Bank but highly volatile stocks such as AMP and Webjet, highly leveraged stocks such as Domino’s Pizza and SEEK, and stocks whose prices were falling prior to the lockdown, such as Myer and Flight Centre.

In contrast, institutional investors were net sellers of all these stocks.

These trends were broadly consistent across industry sectors. The one exception was software and services, where institutions were net buyers through the lockdown and retail investors were net sellers.

Risky motivations

Why has the COVID-19 crisis produced such novel behaviour? We don’t know for sure, but can speculate about a few possibilities.

It may be due to people having fewer spending opportunities and channelling their spare cash into the market in the hope of a speedy rebound and quick returns.

It may be due people looking for entertainment in the absence of usual leisure activities. This has been dubbed the Boredom Markets Hypothesis.

It might also just be another form of gambling – “taking a punt” in the absence of sports betting opportunities.

But given the significant economic uncertainty, recent gains may not be sustained. Many listed companies have withdrawn or suspended the earnings guidance they usually provide to the stock exchange – key information for investors.

We caution awareness of the risks in hoping for the best.

U.S. Stock Futures Rise as Trump Takes Office, Corporate Earnings Awaited

U.S. Stock Futures Rise as Trump Takes Office, Corporate Earnings Awaited  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  U.S. Condemns China's Dominance in Global Shipbuilding and Maritime Sectors

U.S. Condemns China's Dominance in Global Shipbuilding and Maritime Sectors  Apple Downgraded by Jefferies Amid Weak iPhone Sales and AI Concerns

Apple Downgraded by Jefferies Amid Weak iPhone Sales and AI Concerns  Elliott Investment Management Takes Significant Stake in BP to Push for Value Growth

Elliott Investment Management Takes Significant Stake in BP to Push for Value Growth  Why the Middle East is being left behind by global climate finance plans

Why the Middle East is being left behind by global climate finance plans  Ferrari Group to Launch IPO in Amsterdam, Targets Over $1 Billion Valuation

Ferrari Group to Launch IPO in Amsterdam, Targets Over $1 Billion Valuation  SoftBank Eyes Up to $25B OpenAI Investment Amid AI Boom

SoftBank Eyes Up to $25B OpenAI Investment Amid AI Boom  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Investors value green labels — but not always for the right reasons

Investors value green labels — but not always for the right reasons  Do investment tax breaks work? A new study finds the evidence is ‘mixed at best’

Do investment tax breaks work? A new study finds the evidence is ‘mixed at best’  Wall Street Rebounds as Investors Eye Tariff Uncertainty, Jobs Report

Wall Street Rebounds as Investors Eye Tariff Uncertainty, Jobs Report  Insignia Financial Shares Hit 3-Year High Amid Bain and CC Capital Bidding War

Insignia Financial Shares Hit 3-Year High Amid Bain and CC Capital Bidding War  Home ownership is slipping out of reach. It’s time to rethink our fear of ‘forever renting’

Home ownership is slipping out of reach. It’s time to rethink our fear of ‘forever renting’  Gold Prices Rise as Markets Await Trump’s Policy Announcements

Gold Prices Rise as Markets Await Trump’s Policy Announcements  S&P 500 Surges Ahead of Trump Inauguration as Markets Rally

S&P 500 Surges Ahead of Trump Inauguration as Markets Rally  Tempus AI Stock Soars 18% After Pelosi's Investment Disclosure

Tempus AI Stock Soars 18% After Pelosi's Investment Disclosure