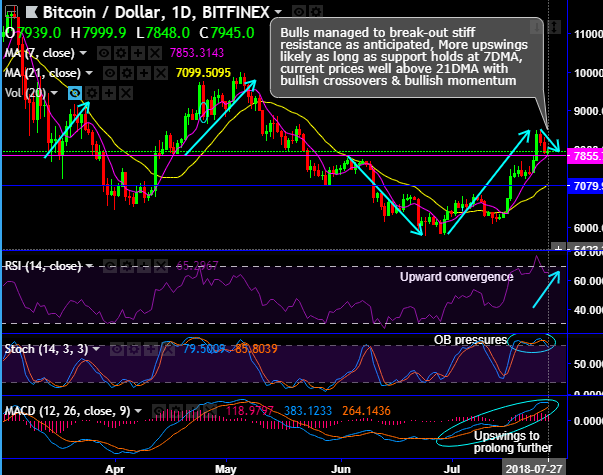

We reiterate BTCUSD prices have been dipping from last 2-3 days on the back of the news that the U.S. Securities and Exchange Commission (SEC) rejected the second attempt of the Winklevoss application to launch a Bitcoin exchange-traded fund (ETF), but the bulls seem to be finding cushion at 7-DMA levels ($7,848 levels) where at this juncture, the pair has acted as its strong support and resistance levels in the recent past.

On the daily plotting, RSI in the overbought territory has signalled little weakness in the previous rallies but holding at 65 levels and fast stochastic curves are also on the verge of a rolling over from the overbought zone.

Whereas, both trend indicators (DMA & MACD) are still in bulls’ favour and indicating upswings to prolong further.

Despite today’s overall bearish sentiment, we reckon that the trend still appears to be bullish as long as the pair holds 7-DMA support as the optimistic views on Bitcoin ETFs from Crypto enthusiasts, such as, Bitwise, VanEck and SolidX are still lingering. If it breaches below that level, then one could foresee bearish trading opportunities upto next support is seen only at $7,099 – 7,079 (i.e. 21-DMA levels).

VanEck is entering into the joint venture with SolidX for the hottest news of its Bitcoin ETF application. While there has been news of these crypto-firms attempting to lobby for SEC approval of Bitcoin ETFs and is voicing that BTC ETFs likely to assist in preventing from price manipulation in the cryptocurrency market.

Elsewhere, the San Francisco-based asset management company, Bitwise filed for the registration of “the first publicly-offered cryptocurrency index exchange-traded fund (ETF)” amid the varied perspectives between highly constructive crypto-aspirants and diplomatic regulators.

The team behind Bitwise, which includes several veterans of the ETF industry, has expertise in technology, security, indexing, and asset management, and is headquartered in San Francisco.

Currency Strength Index: FxWirePro's hourly BTC spot index is at shy above -102 levels (which is bearish), while hourly USD spot index is edging higher at 47 levels (bullish) while articulating (at 11:16 GMT). For more details on the index, please refer below weblink:

China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Mastercard Partners with MoonPay to Unlock Web3 Capabilities in Experiential Marketing

Mastercard Partners with MoonPay to Unlock Web3 Capabilities in Experiential Marketing  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Crypto Investment Platforms eToro and M2 Granted Approvals to Operate in the UAE

Crypto Investment Platforms eToro and M2 Granted Approvals to Operate in the UAE  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Mastercard's Shopping Muse: A New Era in AI-Driven E-commerce Personalization

Mastercard's Shopping Muse: A New Era in AI-Driven E-commerce Personalization