Bitcoin prices soared during Donal Trump’s victory back in 2016. But for now, Bitcoin is continuously breaking its lowest points of 2018. BTC is currently trading at the price of $5,885. After fighting the resistance, Bitcoin broke the record again by falling to $5,960, bears have resumed again. The market cap also dropped below the $100 billion margin during the crash.

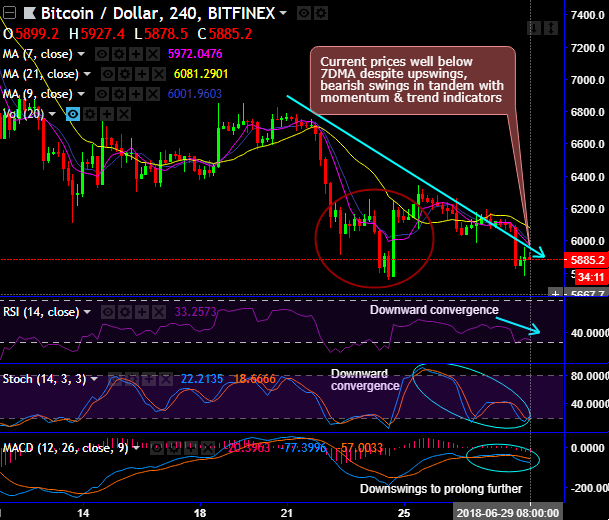

Technically, the current prices are well below 7DMA despite today’s upswings, bearish swings are in tandem with both momentum as well as trend indicators. We see no traces of recovery so far, the major trend is on the verge of retracing 78.6% Fibonacci levels of highs of December-2017 & lows of July-2017 (refer weekly plotting).

The US Senate committee was set up to hear the issue of cryptocurrency potentially being utilized to manipulate future elections as primaries were being held in several states. While the social media platforms during the significant part of 2017 and even this year, have taken a lot of heat over their alleged role in influencing the 2016 U.S. presidential election. During a congressional hearing, cryptocurrencies were put in the same spot at least with regards to the future.

According to Scott Dueweke, a cyber-security veteran and the president of Identity and Payments Association (IDPAY), digital currencies are the flawless tool for use by state actors and foreign parties seeking to influence the political process in the United States.

In the U.S., bitcoin campaign contributions to the political campaign were first allowed by the Federal Elections Committee in 2014. However, the maximum that could be contributed by an individual was set at $100 through the FEC did not limit the amount of Bitcoin contributions that could be made to Super PACs (Political Action Committees).

Dueweke, who is also the director of the identity & secure transactions at DarkTower, was testifying before Senate Judiciary Committee in a hearing that was led by Senator Lindsey Graham, a Republican senator from South Carolina.

Currency Strength Index: FxWirePro's hourly BTC spot index is flashing at -154 levels (which is bearish), while hourly USD spot index was at 85 (bullish) while articulating at (11:34 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary