Malaysia’s new central bank governor Datuk Nor Shamsiah Mohd Yunus is set to preside over her first interest-rate meeting on Wednesday. The Malaysian central bank (BNM) is unlikely to make any changes in its monetary policy during the Monetary Policy Committee (MPC) meeting tomorrow. BNM is widely expected to leave its overnight policy rate (OPR) unchanged at 3.25 percent.

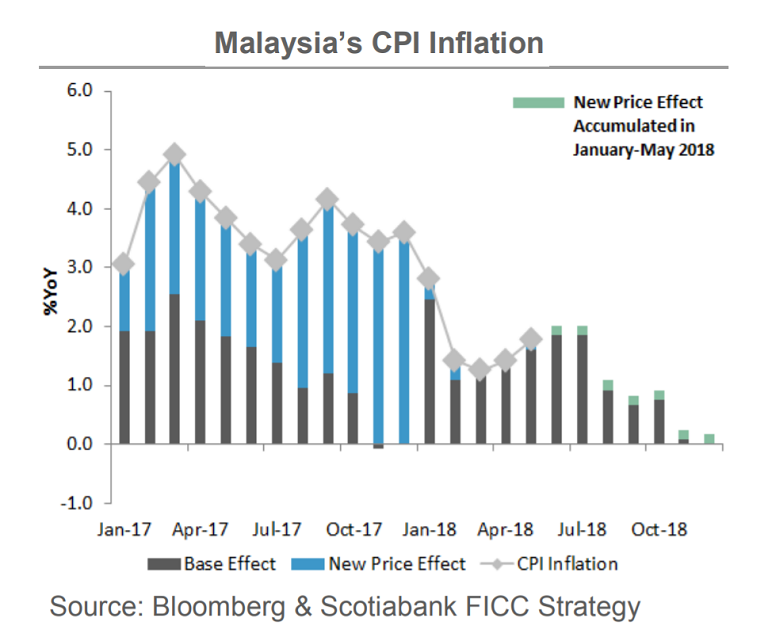

BNM has hiked its policy rate just once this year, by 25 basis points in January. It was the only hike since July 2014. Malaysia's new Prime Minister Tun Dr Mahathir Mohamad scrapped the 6 percent Goods and Services Tax (GST) imposed in 2015, which will likely bring a significant fall in inflation rate. With little inflation pressure in the economy, the new central bank chief has scope to keep policy on hold.

That said, analysts expect the central bank's hawkish bias could be gone. Inflation has turned out to be a lot more benign than what Bank Negara had predicted. Subdued inflation will give Shamsiah an opportunity to dial back some of the hawkishness of her predecessor, who hiked rates in January. A looming trade war between the US and China, Malaysia’s biggest trade partners, could see some slowdown in some sectors. For now, growth forecasts remain solid at over 5 percent for this year.

Further, the ringgit has fared better than its peers amid an emerging market sell-off supported by higher oil prices which have bolstered inflows and strengthened the current-account surplus. The MYR will continue following a broader market tone but with a lower volatility as the nation’s massive current account surplus and bouncing oil prices provide a buffer amid portfolio outflows.

"We believe the BNM will leave its overnight policy rate (OPR) unchanged at 3.25% on Wednesday afternoon, given the nation’s benign inflation outlook and a low historic volatility in the MYR exchange rate," said Scotiabank in a report.

USD/MYR extending weakness from 2018 highs at 1.0490 hit in last week's trade. The pair is down 0.19 percent at the time of writing. Technical indicators on daily charts are turning bearish. Price action currently finds strong support at 200-DMA at 1.0092. Break below will accentuate weakness. Scope then for test of 3.97 levels.

FxWirePro's Hourly USD Spot Index was at 126.999 (Bullish) at 1100 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand