Bank Negara Malaysia (BNM) is expected to remain accommodative and growth supportive, with the Overnight Policy Rate (OPR) likely to be maintained at 3.25 percent throughout this year, according to the latest report from ANZ Research.

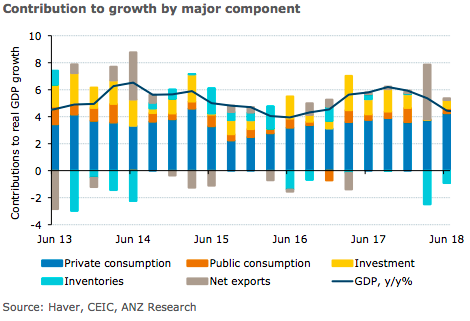

Malaysia’s gross domestic product (GDP) registered 4.5 percent y/y growth in Q2, down from 5.4 percent y/y in Q1. Private consumption, which has been the mainstay of growth, found further support from the withdrawal of GST on June 1.

Weak exports, coupled with buoyant imports, resulted in net exports subtracting 1.6ppts from growth in the quarter. The strains from global trade tensions have become apparent in the loss of momentum in exports in recent months.

Private consumption, which expanded 8 percent y/y compared with 6.9 y/y previously, has been the mainstay of growth and received a fillip with the withdrawal of the GST on June 1. Higher investment in “machinery & equipment” helped buoy overall investment activity at 2.2 percent y/y in Q2 (Q1: 0.1 percent). However, tepid construction activity resulted in investment in structures growing a meagre 2.1 percent y/y.

In the run up to the May elections, firms seem to have held back. Post-elections, as the new government placed key infrastructure projects under review, investments linked to such projects seem to have been delayed further. After the large draw-down in inventories in Q1, restocking demand is yet to pick up.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell