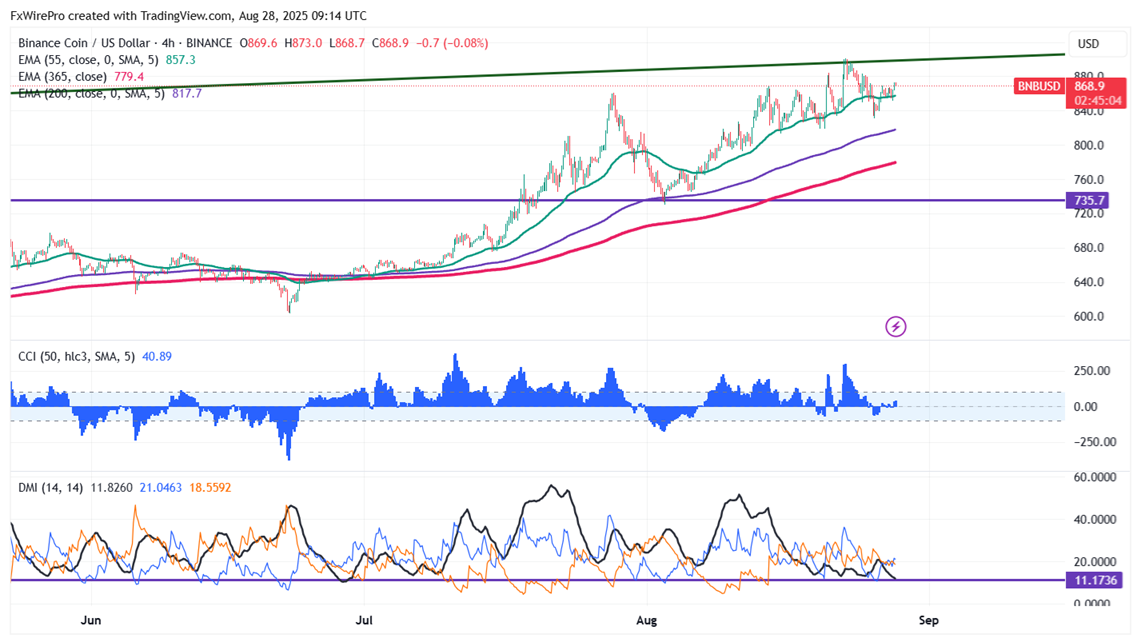

BNBUSD recovered above $850 following the footsteps of Bitcoin. It hits an intraday high of $873 and is currently trading around $868.90.

Short-term trend remains bullish as long as support $779 (365-4H EMA) holds. It trades above the 55,200 and 365 EMA on the 4-hour chart. Near-term support is around $830; any close below targets $800/$780/$755/$730/$700/$670/$650/$644/$628/$598. If the pair closes below $500, it potentially leads to further declines towards $400.

Immediate Resistance is at $900.Any breakout above this resistance confirms bullish momentum and a jump towards $943/$1000.

Indicators ( 4-hour Chart)

Directional Movement Index: Bearish

CCI (50): Bullish

Trading Strategy

It is good to buy on dips around $830 with a stop-loss set at $780 and a target price of $1000.