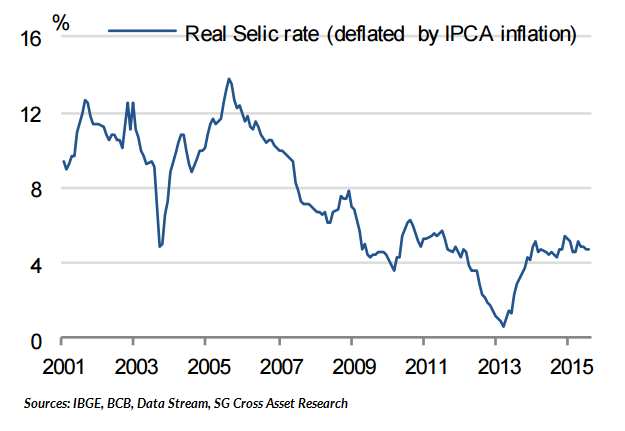

Brazil's October COPOM meeting is expected to be a non-event with markets unanimous in calling for rates to be kept on hold at 14.25% this Wednesday. Brazil's macro economic and financial conditions have deteriorated since the September Copom meeting. Plunge in the Brazilian real to record lows has driven up fuel and food prices, leading the inflation rate towards 10 percent this year.

Brazil is already running a budget deficit of 9 percent of GDP, and growing. Mounting domestic political and legislative concerns coupled with constraints on the revenue side mean that the fiscal targets will be missed by a wide margin both in 2015 and 2016. This is bound to put further pressure on financial conditions.

Rising inflation expectations combined with uncertainty over political and budgetary crisis have clouded Brazil's economic forecasting and weighed on business decisions. On the growth front, August retail sales and labour market developments were worse than expected which put further downside risks on the recently revised growth forecast.

Owing to sharp deterioration in financial conditions the BCB has pledged to keep rates high for as long as needed. One cannot rule out further monetary tightening in this cycle, in any case, a rate hike would be seen as an effort to ensure financial stability and not primarily due to further inflationary pressure. Even after some recent respite following a cabinet reshuffle by President Dilma Rousseff, rate futures are still pricing in more than 150 basis points of rate increases through the next 12 months.

"Although we don't discard the chance of a rate hike, the price action looked more to be panic-driven than anything else," BBH strategists, led by Marc Chandler, wrote in a note.

Societe Generale expects a rate cut of only 50bp in 2016, vs a 125bp rate cut previously. The consensus view of a rate cut of about 175bp in 2016 is probably too optimistic.

The IPCA-15 index for mid-October will also be released today. Expectations are for annual inflation rate to near 10 percent in mid-October after state-run oil company Petrobras raised fuel prices to adjust for a massive currency drop. Consumer prices likely gained 9.79 percent in the 12 months through mid-October, the highest since December 2003 (According to Reuters Survey)

USD/BRL is trading at 3.9040 as of 1010 GMT, Wednesday. The pair has corrected slightly from record highs of 4.2476 hit on September 24th.

BCB likely to stand pat through H1'16, upside risks for inflation outlook persist

Wednesday, October 21, 2015 10:53 AM UTC

Editor's Picks

- Market Data

Most Popular

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate