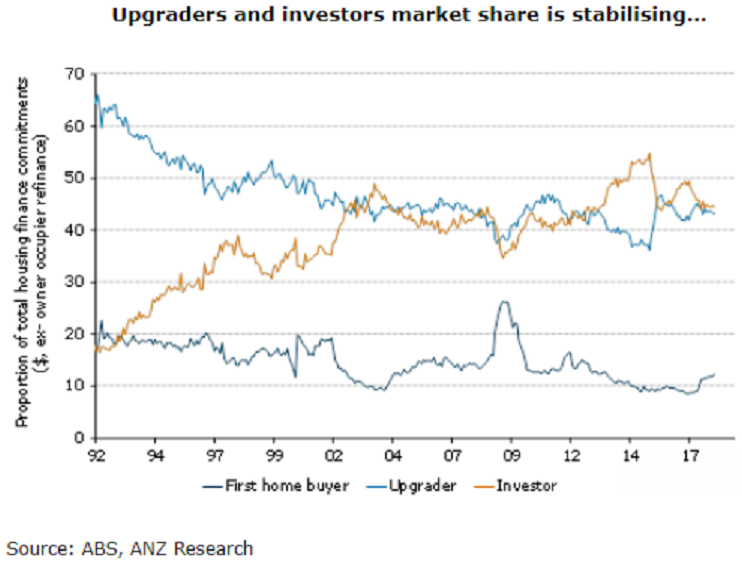

Australia’s value of new housing finance approvals rose again in February, with growth across all sectors. The increasing presence of first home buyers is driving strength in the owner-occupier segment, while investor borrowing appears to have finished its earlier decline.

The value of Australia’s housing finance commitments rose by another 1.0 percent m/m. This pushed annual growth back into positive territory (albeit only just), providing further evidence that housing finance is stabilizing.

The monthly increase was driven by the owner-occupier segment, which rose 1.4 percent m/m. Investors were up a more subdued 0.5 percent m/m, following from the 1.4 percent m/m rise in January. This is the first time in nearly 18 months that investor borrowing has posted consecutive increases.

Underpinning the rise in owner-occupier borrowing was another solid increase in first home buyer activity. First home buyer lending is up more than 40 percent over the past year, and accounted for 12.4 percent of all housing finance in February.

"That is the highest share of borrowing in nearly five years. From the perspective of getting first home buyers into the market, the NSW and Victorian state governments’ stamp duty incentives are working a charm," ANZ Research commented in its latest report.

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target