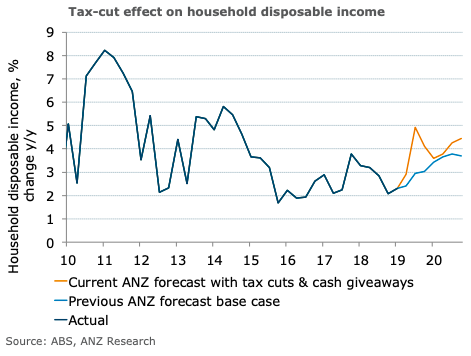

Australia’s tax cuts is expected to boost household consumption in the September and December quarters by approximately $7.2 billion; as returns vary in timing; a slower and more spread-out pattern of spending growth is likely, according to the latest report from ANZ Research.

Tax cuts are arriving in the form of tax refund payments from July. While there is some uncertainty around the timing of the legislation that will approximately double the already approved tax cut, the boost to Australian households might be considerable. There are also some one-off payments to households.

This could materially impact consumer spending over the rest of 2019. Because the proposed tax cuts would be delivered in a lump sum with tax returns, the household income and spending boost is likely to concentrate in the second half of 2019, the report added.

Like the post-GFC bonuses, the proposed tax cuts will be delivered as one sum, which generally leads to shorter-term spikes in spending. The key difference being that they would be delivered through tax returns, rather than automatic bonus payments.

So household use of tax cut will be spread out over the second half of 2019, whereas the post GFC was more concentrated. This will likely mean the impact on the data is more diffuse.

"Over the last ten years, however, Australian households have changed. We are more indebted and our non-discretionary expenses are higher; we spend more on travel and less on retail. And this may affect how we spend, this time around," ANZ Research further added in its comments.

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility