The best word to describe the way Australia taxes alcoholic drinks is “incoherent”.

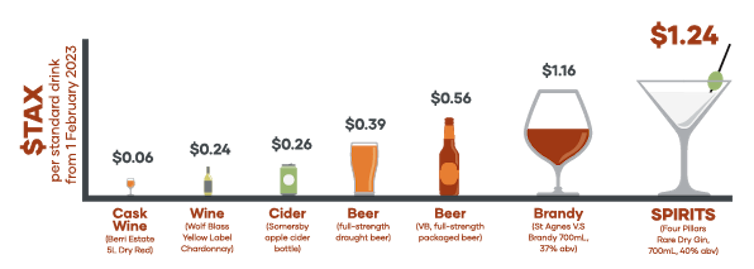

It was the word used by the 2010 Henry Tax Review to describe a system in which some wine effectively faces no alcohol tax, expensive wine is taxed heavily and cask wine lightly, beer (but not wine) is taxed by alcohol content, brandy is taxed less than other spirits, and cider is taxed differently to beer.

Industry calculations suggest cask wine is taxed at as little as six cents per standard drink, mid-price wine at 26 cents, bottled beer at 56 cents, and spirits at $1.24.

Australian Distillers Association

And yet it is cask wine that is often said to do the most damage.

The Henry Review recommended taxing all drinks containing more than a small amount of alcohol at the same rate per unit of alcohol, regardless of type. It was a recommendation backed by specialists in Australia’s tax system.

Implicit, and largely unexamined, in these recommendations is the assumption that alcohol does the same damage in whatever form it is taken.

Our new study, linking drinkers’ risky behaviours to the types of alcoholic beverages they mostly consume, finds this isn’t so.

Damage depends on the type of drink

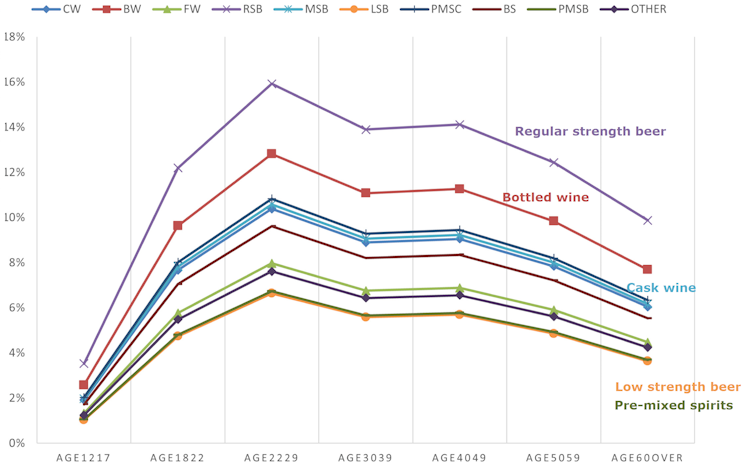

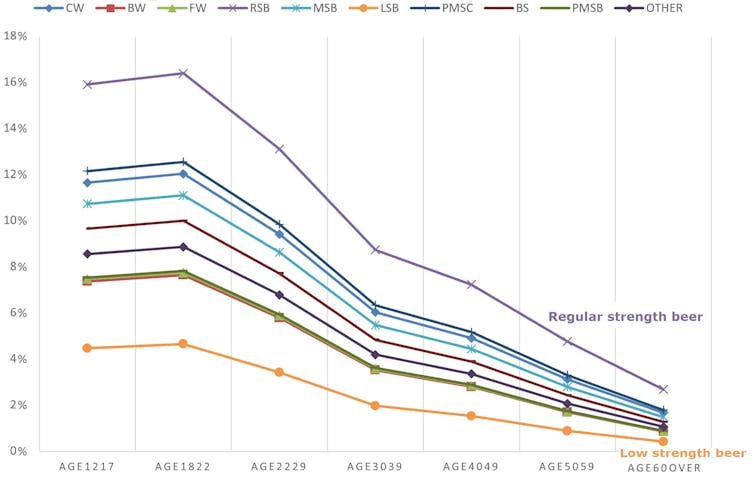

Using data from six waves of an Australian recreational drug survey, we find that regular-strength beer and pre-mixed spirits in a can rank among the highest in their links to both drink-driving and hazardous, disturbing or abusive behaviours.

Mid-range are mid-strength beer, cask wine, and bottled spirits and liqueurs.

At the bottom are low-strength beer and pre-mixed spirits in a bottle, which have the weakest links to risky and abusive behaviours when intoxicated.

Probability of drink driving, by age and beverage type

RSB = Regular-Strength Beer; LSB = Low-Strength Beer; MSB = Mid-Strength Beer; BW = Bottled Wine; FW = Fortified Wine; CW = Cask Wine; PMSC = Pre-Mixed Spirits in a Can; PMSB = Pre-Mixed Spirits in a Bottle; BS = Bottled Spirits and Liqueurs. Source: Economic Record

Some of the relationships vary with the type of damage. While bottled wine is linked to a moderate to high probability of drink-driving, it is also linked to a low probability of hazardous, disturbing or abusive behaviours.

Pre-mixed spirits in a bottle are related to a low probability of both drink driving and hazardous, disturbing and abusive behaviours. But when account is taken of the gender of the drinkers (so-called alcopops are typically drunk by females), we find them no longer as safe.

Probability of hazardous, disturbing or abusive behaviour

RSB = Regular-Strength Beer; LSB = Low-Strength Beer; MSB = Mid-Strength Beer; BW = Bottled Wine; FW = Fortified Wine; CW = Cask Wine; PMSC = Pre-Mixed Spirits in a Can; PMSB = Pre-Mixed Spirits in a Bottle; BS = Bottled Spirits and Liqueurs. Source: Economic Record

Our study suggests that Australia’s haphazard system of taxing alcohol might have got some things right. Beer, which is typically taxed more highly than wine, seems to do more damage.

But it has got some things wrong. Cask wine appears to be significantly undertaxed relative to the damage it does.

More broadly, our findings suggest that if alcohol is to be taxed according to the damage it does, the tax system we adopt will need to be more complicated than a single rate for every unit of alcohol regardless of the form in which it comes.

Norway Opens Corruption Probe Into Former PM and Nobel Committee Chair Thorbjoern Jagland Over Epstein Links

Norway Opens Corruption Probe Into Former PM and Nobel Committee Chair Thorbjoern Jagland Over Epstein Links  American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns

American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns  Federal Judge Blocks Trump Administration Move to End TPS for Haitian Immigrants

Federal Judge Blocks Trump Administration Move to End TPS for Haitian Immigrants  Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape

Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape  U.S. Lawmakers to Review Unredacted Jeffrey Epstein DOJ Files Starting Monday

U.S. Lawmakers to Review Unredacted Jeffrey Epstein DOJ Files Starting Monday  SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates

SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates  Weight-Loss Drug Ads Take Over the Super Bowl as Pharma Embraces Direct-to-Consumer Marketing

Weight-Loss Drug Ads Take Over the Super Bowl as Pharma Embraces Direct-to-Consumer Marketing  Taiwan Says Moving 40% of Semiconductor Production to the U.S. Is Impossible

Taiwan Says Moving 40% of Semiconductor Production to the U.S. Is Impossible  CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences

CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences  Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports

Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports  Supreme Court Signals Doubts Over Trump’s Bid to Fire Fed Governor Lisa Cook

Supreme Court Signals Doubts Over Trump’s Bid to Fire Fed Governor Lisa Cook  Ghislaine Maxwell to Invoke Fifth Amendment at House Oversight Committee Deposition

Ghislaine Maxwell to Invoke Fifth Amendment at House Oversight Committee Deposition  US Judge Rejects $2.36B Penalty Bid Against Google in Privacy Data Case

US Judge Rejects $2.36B Penalty Bid Against Google in Privacy Data Case  Trump Administration Sued Over Suspension of Critical Hudson River Tunnel Funding

Trump Administration Sued Over Suspension of Critical Hudson River Tunnel Funding  Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Washington Post Publisher Will Lewis Steps Down After Layoffs

Washington Post Publisher Will Lewis Steps Down After Layoffs