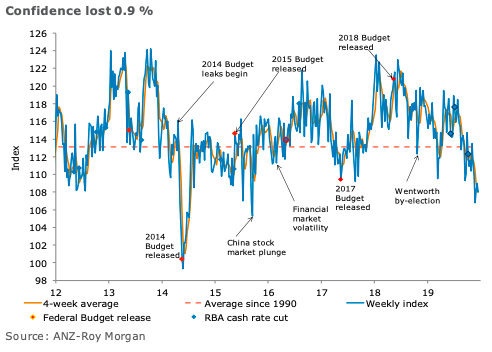

Australia’s ANZ-Roy Morgan consumer confidence fell 0.9 percent last week, primarily due to the 6.4 percent fall seen in the ‘Time to buy a major household item’ sub-index.

Financial conditions were mixed with ‘current finances’ down by 1.5 percent, while ‘future financial conditions’ gained 3.7 percent. Economic conditions were also mixed.

‘Current economic conditions’ rose 1.6 percent, while ‘future economic conditions’ were down 1.2 percent. The four-week moving average of ‘inflation expectations’ was up 0.1ppt to 4.0 percent.

"Momentum fizzled out this week after two successive weekly gains. A delayed response to the soft GDP result and weak retail sales may be at work, as well as the news flow around the bush fires and associated smoke haze. The weakness seen in the ‘time to buy a household item’ sub-index was almost enough to take it to its lowest level since the global financial crisis. It seems the turn in the housing market has not yet flowed through to sentiment around household items. We note that consumer confidence is not the be all for financial conditions. The financial wellbeing of Australians is holding up better," said David Plank, ANZ’s Head of Australian Economics.

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed