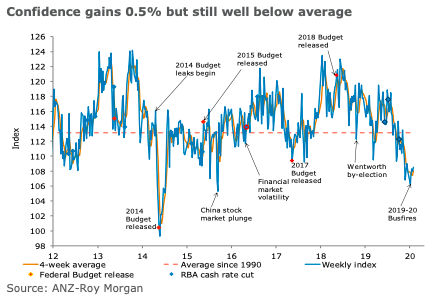

Australia’s ANZ-Roy Morgan consumer confidence edged up a touch last week, reversing the prior week’s decline, remaining well below average. Overall financial conditions were little changed, with offsetting moves in ‘current’ and ‘future’ finances.

Further ‘Current economic conditions’ gained 2.1 percent, while ‘future economic conditions’ declined 2.5 percent last week.

‘Time to buy a major household item’ gained 2.7 percent compared to a decline of 2.4 percent previously. The four-week moving average of ‘inflation expectations’ was up by 0.1ppt to 4.0 percent.

Meanwhile, the weekly reading rose to 4.2 percent, its highest level since early September, perhaps reflecting the lift in headline inflation reported in the December 2019 CPI report.

"Broadly stable consumer confidence in the face of news about the coronavirus, albeit at a level well below average, provides some comfort for the outlook. The decisive policy action taken the Government to protect the health and wellbeing of Australian citizens may be seen as a positive development that provides at least some offset to community concerns about the health and economic consequences of the virus. The coming week will be dominated by RBA commentary and some key data, not least the December retail sales figure, which is expected to confirm weak Christmas spending," said David Plank, ANZ’s head of Australian Economics.

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom