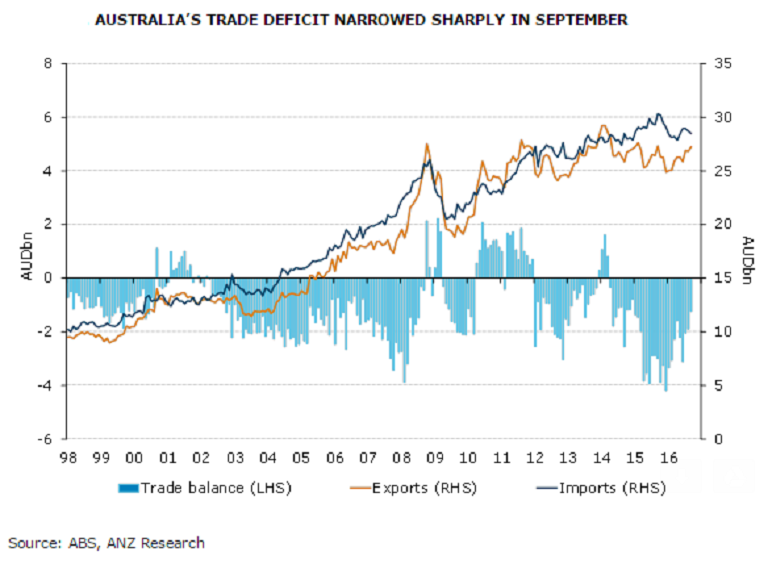

Australia’s trade balance improved during the month of September, driven by strong exports of coal and significantly beating market expectations. This surprise improvement was driven by a spike in resource exports, with consumer imports being a little weaker, leading to the decline.

The Australian trade deficit narrowed to AUD1.23 billion in September from an upwardly revised AUD1.89 billion in August, much better than the market consensus. Total exports rose 1.6 percent in September, with the increase concentrated in resource exports. However, gold exports, which tend to be very volatile, dropped a sizeable 19 percent in the month.

Exports excluding gold bounced a strong 4.0 percent in September. This strength in exports was largely driven by a rise in other resource exports, which were up 3.9 percent in September. While iron ore exports were unchanged, the value of coking exports spiked, up a sharp 12.1 percent, likely underpinned by strong price gains. LNG exports continued to rise at a moderate rate.

Imports dropped slightly, down 0.8 percent in September. The prime driver was weaker imports of consumption goods, down 2.8 percent, while capital goods imports (ex-aircraft) were marginally higher, up 0.2 percent in the month and intermediate goods rose a solid 2.2 percent.

Despite the stronger exchange rate, net tourism and education exports continued to increase at a solid rate, up 4 percent in September. The Reserve Bank of Australia maintained its key benchmark rate at a record low of 1.50 percent in its November 1 monetary policy meeting, judging that unchanged policy is consistent with growth and inflation targets.

Meanwhile, the benchmark Australia's S&P/ASX 200 index traded 0.65 percent higher at 5,197.5 by 05:00 GMT.

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength