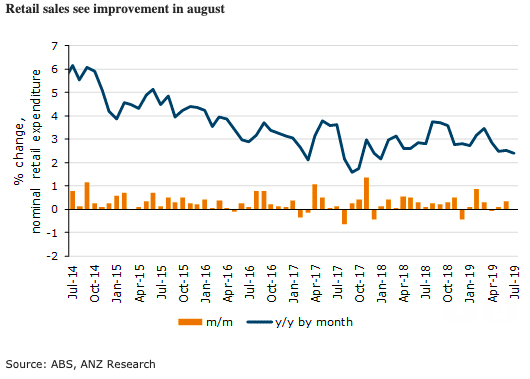

Australia’s retail sales grew by 0.4 percent in August, below ANZ and market expectations. This upgrade compared with recent months (0.2 percent m/m average for the last 6 months) represents the early effects of tax and rate cuts, ANZ Research reported.

Uncertainty about the labour market and other economic conditions may have caused some shyness among recipients of extra income - including early tax cut recipients and mortgagees (who can reduce payments as rates fall).

Annual growth increased to 2.6 percent. This is a little higher than the past few months, but still below the 1-yr, 3-yr and 5-yr averages.

Clothing was a standout, with 4.9 percent y/y growth after a strong monthly result (1.8 percent m/m). Department stores (1.1 percent m/m) and recreational goods (2.9 percent m/m) also saw strong monthly growth, hinting that tax cuts were stimulating short-term discretionary spending.

In y/y terms, key non-discretionary categories including supermarket and grocery stores (4.2 percent y/y) and pharmaceutical, cosmetics and toiletries (4.8 percent y/y) continued to see stronger growth than discretionary categories. This speaks to the longer term budget pressures on households, who are focusing more on “essentials” and less on “nice to haves”.

Monthly growth was strongest in QLD (0.8 percent m/m) and ACT (1.9 percent m/m) while annual results show strength in QLD and VIC, and weakness in NSW.

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns