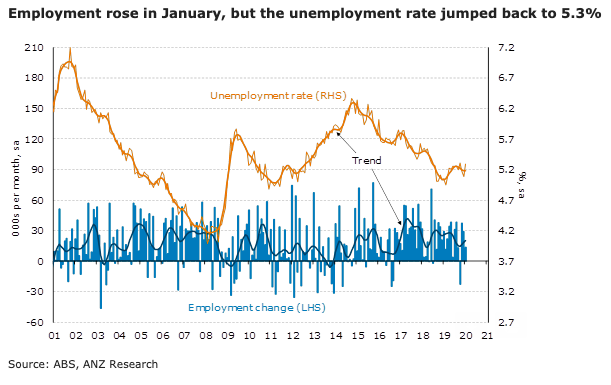

In a reversal of December’s move, Australia’s unemployment rate ticked back up to 5.3 percent in January, while employment rose modestly. The underutilisation rate jumped to a 19-month high. Alongside this, the participation rate edged back to 66.1 percent, just shy of the record high of 66.2 percent recorded in August last year.

The RBA has been clear in its focus on the labour market as a key barometer of the health of the economy. It would be disappointed by the lift in the unemployment rate in January, but would likely characterise it as broadly stable at 5¼ percent,

After a strong 28.7k rise in December, employment rose by a more moderate 13.5k in January. This was stronger than our own forecast for a fall of 5k, but broadly in line with market expectations. Full-time jobs (+46k) drove the gains in January, while part-time jobs fell 33k. Aggregate hours worked actually fell 0.4 percent in the month.

Despite the rise in employment, the unemployment rate rose from 5.1 percent to 5.3 percent. Underemployment also rose, up from 8.3 percent to 8.6 percent, lifting the underutilisation rate to 13.9 percent, the highest rate since June 2018.

The ABS reported that, “there was no notable impact on Labour Force statistics from recent bushfires”.

"Leading labour market indicators continue to suggest a deterioration in unemployment over coming months. In our view, a further lift in the unemployment rate will be enough to push the RBA over the line for another rate cut, most likely in Q2," ANZ Research commented in its latest report.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out