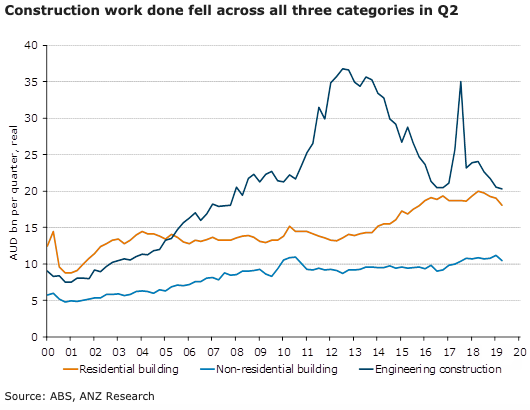

Australia’s construction work done fell for a fourth consecutive quarter in Q2. The contraction in residential activity accelerated, non-residential building activity dropped across both private and public sectors, and the weakness in engineering construction persisted, with only a small uptick in public sector work done, according to the latest report from ANZ Research.

Construction activity in Australia fell 3.8 percent q/q in Q2 2019 to be down 11.1 percent y/y. This was the fourth (and largest) quarterly contraction in a row. The decline in residential construction worsened to -5.1 percent q/q, dragging the annual result down to -9.6 percent. Non-residential building saw an even larger fall of 6.6 percent q/q and engineering construction rounded off the trifecta, down 1.1 percent q/q.

After two quarters of disappointing results, public engineering construction eked out a 0.9 percent gain in Q2. However, it remains 16.1 percent down from the peak a year ago despite the solid pipeline of infrastructure projects. Public non-residential building dropped a further 4.9 percent q/q, following the 2.9 percent fall in Q1.

New building (-5.3 percent) and alterations and additions (-3.3 percent) combined to drag down private residential activity to its lowest level since late 2015. Private engineering construction has not yet bottomed out, falling 2.5 percent q/q, while private non-residential building lost all of the gains from Q1 and then some, down 7.3 percent q/q.

Western Australia (+1.4 percent q/q) was the only state to see a rise in construction, driven by a 2.1 percent q/q increase in engineering construction along with smaller improvements in residential and non-residential building. Queensland (-6.0 percent) recorded the largest decline in construction activity followed by South Australia (-4.8 percent), Victoria (-4.4 percent), Tasmania (-4.1 percent) and New South Wales (-1.9 percent).

"The sharper-than-expected fall in construction activity during the quarter will undermine GDP growth in Q2 2019 and puts downside risk on our pick," the report further commented.

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient