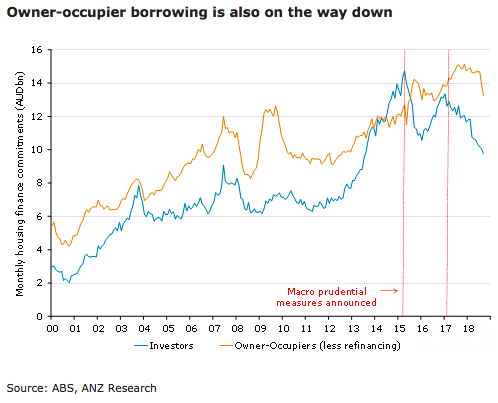

Australia’s housing finance for the month of September fell in line with expectations in September, with declines across all segments. The recent fall in owner-occupier finance suggests that weaker sentiment is now also having an impact on the broader market, according to the latest report from ANZ Research.

The value of housing finance commitments fell sharply again in September. Following some downward revisions to the August results, the value of finance has fallen 7.5 percent in the last two months, which is one of the weakest consecutive results on record.

For the second month running, most of the monthly decline was in the owner-occupier segment. Owner-occupier approvals are now 11 percent lower than a year ago, which is the largest decline since 2010.

While most of the focus around credit tightening has been on investors, the accelerating decline in owner-occupier borrowing suggests that weaker sentiment in the housing market is having an impact on the demand for credit.

"Further weakness in house prices is likely, although smaller loans should be considered a positive development from a financial stability point of view," the report commented.

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed