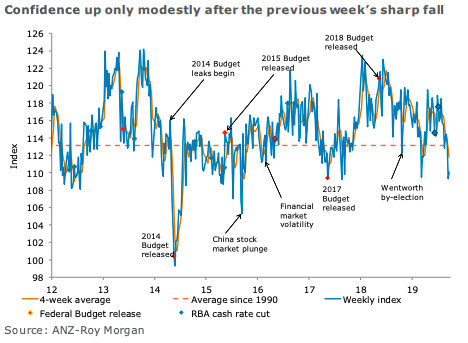

Australian ANZ-Roy Morgan consumer confidence gained 0.7 percent last week after losing 3.5 percent in the previous reading. Strength was relatively broadly based across the sub-indices, although the “time to buy a household item” index dropped a sharp 3.8 percent and is now at its lowest level in ten years.

Current financial conditions gained 1.9 percent and remain above the long run average, while future financial conditions gained 1.6 percent. The economic conditions sub-indices also rose, with current economic conditions up 3.6 percent and future economic conditions up 1.0 percent.

Both economic sub-indices remain well below their long run averages. The four week moving average for inflation expectations remained stable at 4.1 percent.

"The modest rise in confidence leaves it well below its long run average. The weakness in the time-to-buy-a-household-item index is particularly disappointing, given that tax cuts should be supporting this measure. Rising concerns over the impact of the stimulus, combined with the lift in the unemployment rate in August and ongoing global easing in monetary policy settings, suggest to us that the RBA will likely cut rates again in October. So far, though, consumers seem impervious to both fiscal and monetary stimulus, and the combination of weak wage growth and high levels of debt may prove to be the more dominant driver of confidence and spending," said Felicity Emmett, ANZ’s Senior Economist.

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022