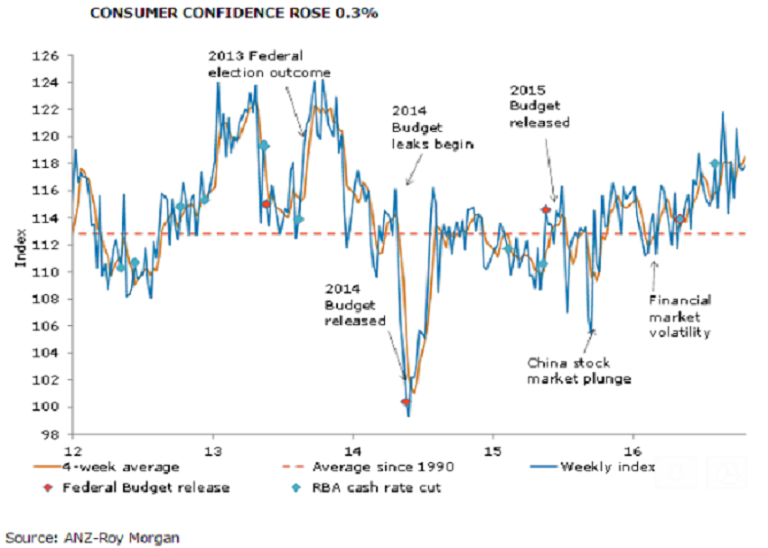

Consumer confidence in Australia edged higher during the week ended October 17, following growing optimism over the country’s housing and labor market and an upbeat economic outlook in the near term.

Australia’s ANZ-Roy Morgan consumer confidence edged higher by 0.3 percent in the week ending October 17, reversing the 0.3 percent fall last week. While the headline index has changed little over the past two weeks, there has been considerable variation in the sub-indices.

Further, consumers’ views towards their current finances fell 2.4 percent last week, while views towards future finances rose 1.0 percent. Both of these sub-indices remain well above their long-run averages.

Also, consumers remained slightly more confident of the economic outlook with the 12-month outlook improving by 0.4 percent. The 5-year ahead outlook was largely unchanged at +0.1%, following a 0.7 percent rise last week.

Meanwhile, household views on whether 'now is a good time to buy a household item' rose by a solid 2.0 percent.

"Confidence remains on an upward trend and well above its long-run average. A strong housing market and a declining unemployment rate are clearly supporting overall confidence. The key for the broader economic outlook, though, is whether rising confidence can translate into stronger spending, particularly given the high level of household debt," said Felicity, Emmett, Head, Australian Economics, ANZ.

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality