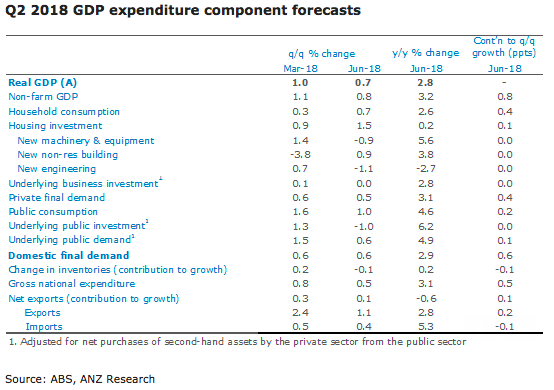

Australia’s gross domestic product (GDP) for the second quarter of this year is expected to have risen a solid 0.7 percent q/q, following a rise of 1.0 percent in Q1. This would see annual growth edge down to 2.8 percent, although annualised H1 growth would be a strong 3.5 percent, according to the latest report from ANZ Research.

In tomorrow’s report, the focus is likely once again to be on the household indicators – consumption and wages. Strong growth in retail sales volumes (1.2 percent) suggest a solid outcome for Q2 consumer spending although keep in mind that retail spending accounts for only around 30 percent of consumption.

Weakness in car sales and some services is likely to provide some offset to the retail strength. On wages, the GDP measure of average wages will be closely watched. Preliminary data suggest that this is likely to show ongoing modest acceleration, consistent with the broad sweep of wages indicators.

"The investment numbers will also be closely watched given their importance in the current upswing. While the capex survey suggested mining investment fell sharply, we expect to see another solid rise in non-mining investment," the report commented.

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns