British chip designer Arm (NASDAQ:ARM) is expanding its footprint in Southeast Asia as demand for artificial intelligence (AI) and data centers surges across the region. Speaking at the Fortune Brainstorm AI Singapore event, Arm’s chief commercial officer Will Abbey highlighted the market’s strong potential, calling Southeast Asia “a hotbed of activity.”

The company’s expansion strategy follows a $250 million partnership with Malaysia announced earlier this year, marking Arm’s first country-level collaboration. According to Abbey, Singapore could be next in line for a similar agreement as Arm strengthens its presence in one of the world’s fastest-growing digital economies.

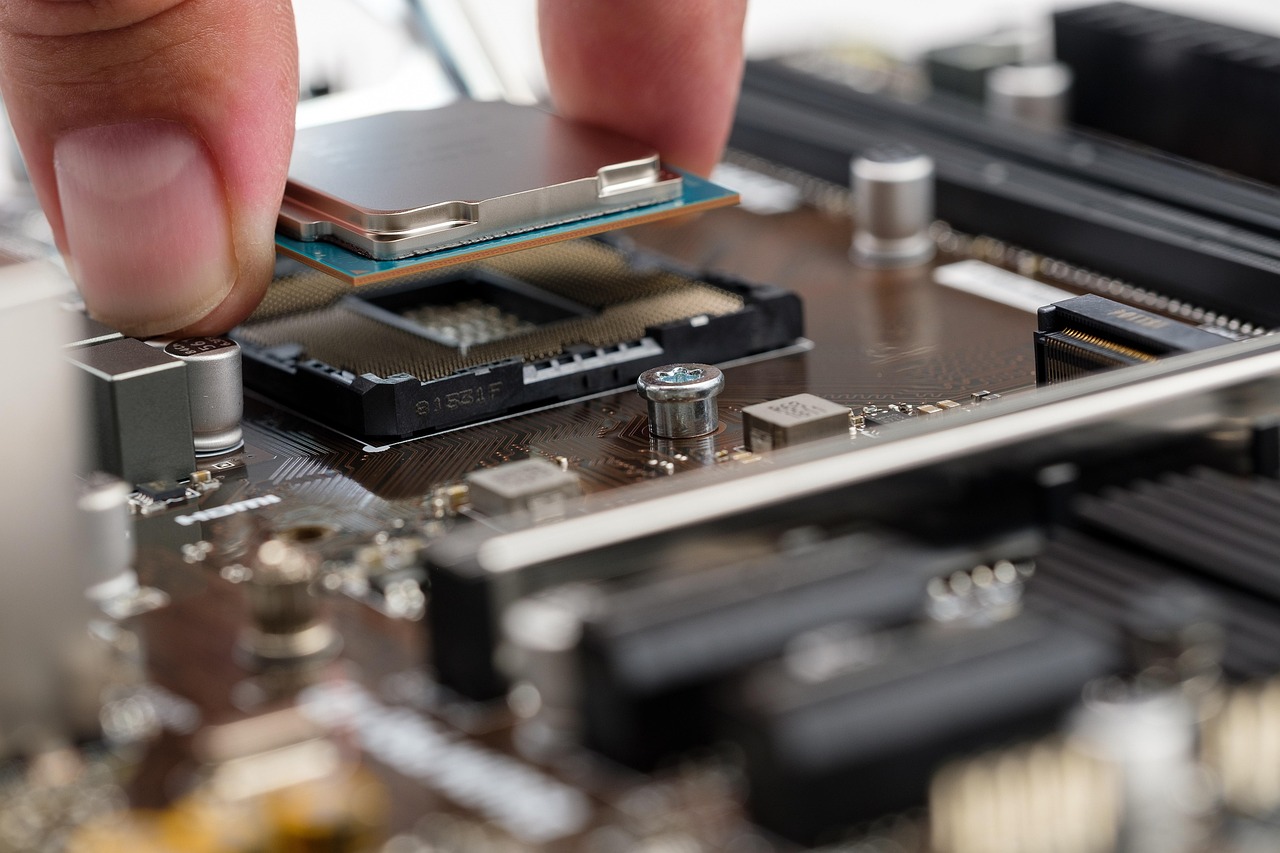

Southeast Asia has become a prime destination for technology investments, driven by rising internet usage, cloud adoption, and government-backed initiatives to build digital infrastructure. The region’s increasing focus on AI innovation and data-driven services has accelerated demand for advanced semiconductor solutions. Arm, whose chip designs power billions of smartphones and devices worldwide, sees an opportunity to play a pivotal role in supporting this growth.

By aligning with regional governments and technology partners, Arm aims to deepen its role in shaping the future of AI and data center ecosystems. The company’s strategic push underscores its confidence in Southeast Asia’s expanding digital landscape, where hyperscale data centers and AI-driven applications are set to fuel the next wave of economic transformation.

As global competition intensifies in the semiconductor industry, Arm’s commitment to Southeast Asia highlights the region’s growing influence in the race for advanced computing and innovation. With Malaysia already on board and Singapore a potential next step, Arm is positioning itself at the center of one of the most dynamic technology markets in the world.

SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates

SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates  Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports

Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports  TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment  Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links  Anthropic Eyes $350 Billion Valuation as AI Funding and Share Sale Accelerate

Anthropic Eyes $350 Billion Valuation as AI Funding and Share Sale Accelerate  Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch

Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch  Instagram Outage Disrupts Thousands of U.S. Users

Instagram Outage Disrupts Thousands of U.S. Users  Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains

Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains  FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns

FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns  Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate  TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans

TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans  Australian Scandium Project Backed by Richard Friedland Poised to Support U.S. Critical Minerals Stockpile

Australian Scandium Project Backed by Richard Friedland Poised to Support U.S. Critical Minerals Stockpile  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  SpaceX Updates Starlink Privacy Policy to Allow AI Training as xAI Merger Talks and IPO Loom

SpaceX Updates Starlink Privacy Policy to Allow AI Training as xAI Merger Talks and IPO Loom  Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks

Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks  SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO

SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO  SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off