Chip designer Arm Holdings (NASDAQ:ARM) reported stronger-than-expected third-quarter earnings, but its muted outlook for the current quarter led to a more than 5% drop in after-hours trading.

The company posted earnings per share (EPS) of $0.39, surpassing analysts' expectations of $0.25. Revenue reached $983 million, exceeding the projected $946.8 million. Despite these strong results, investors reacted to Arm’s Q4 forecast, which fell mostly in line with Wall Street predictions.

For the fourth quarter, Arm expects EPS between $0.48 and $0.56, compared to analysts’ consensus of $0.53. Revenue is projected to range from $1.175 billion to $1.275 billion, closely aligning with the $1.23 billion forecast.

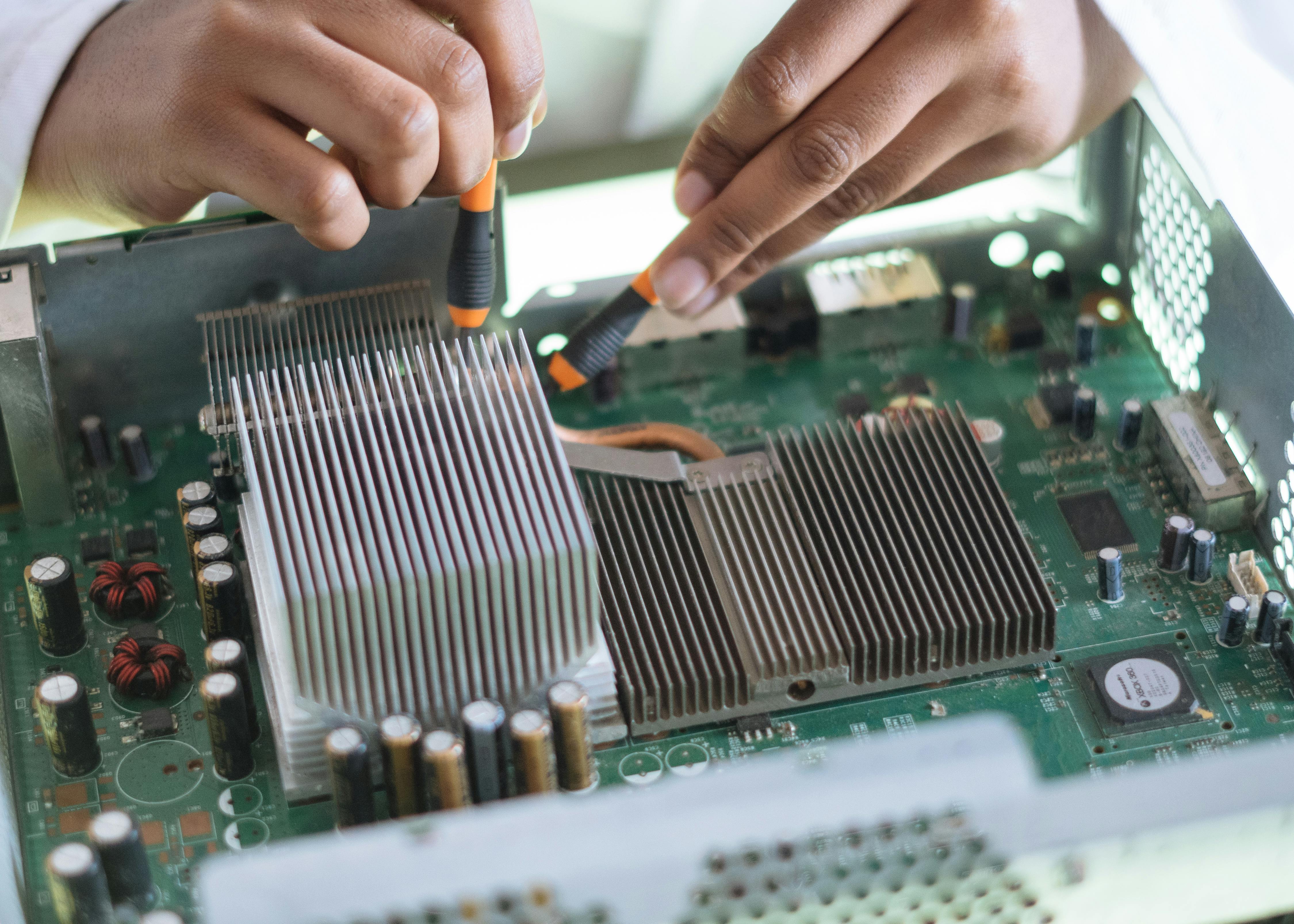

Arm’s growth is fueled by the rising demand for AI-driven semiconductor designs. The company licenses its energy-efficient chip architectures to top semiconductor firms, benefiting from the industry's shift toward power-efficient computing.

Despite the positive earnings surprise, the market’s reaction suggests concerns over growth sustainability and valuation expectations. Investors may be reassessing Arm’s long-term AI market positioning and whether its current trajectory justifies its stock price.

As AI adoption accelerates, Arm remains a key player in the semiconductor sector, with its designs playing a crucial role in next-generation computing. However, its stock performance will likely depend on how well it can meet future demand and sustain revenue growth in an increasingly competitive market.

Boeing Secures New Labor Contract With Former Spirit AeroSystems Employees

Boeing Secures New Labor Contract With Former Spirit AeroSystems Employees  Elon Musk’s SpaceX Acquires xAI in Historic Deal Uniting Space and Artificial Intelligence

Elon Musk’s SpaceX Acquires xAI in Historic Deal Uniting Space and Artificial Intelligence  Using the Economic Calendar to Reduce Surprise Driven Losses in Forex

Using the Economic Calendar to Reduce Surprise Driven Losses in Forex  Oracle Plans $45–$50 Billion Funding Push in 2026 to Expand Cloud and AI Infrastructure

Oracle Plans $45–$50 Billion Funding Push in 2026 to Expand Cloud and AI Infrastructure  Palantir Stock Jumps After Strong Q4 Earnings Beat and Upbeat 2026 Revenue Forecast

Palantir Stock Jumps After Strong Q4 Earnings Beat and Upbeat 2026 Revenue Forecast  Hyundai Motor Lets Russia Plant Buyback Option Expire Amid Ongoing Ukraine War

Hyundai Motor Lets Russia Plant Buyback Option Expire Amid Ongoing Ukraine War  Jensen Huang Urges Taiwan Suppliers to Boost AI Chip Production Amid Surging Demand

Jensen Huang Urges Taiwan Suppliers to Boost AI Chip Production Amid Surging Demand  Boeing Signals Progress on Delayed 777X Program With Planned April First Flight

Boeing Signals Progress on Delayed 777X Program With Planned April First Flight  Nvidia Confirms Major OpenAI Investment Amid AI Funding Race

Nvidia Confirms Major OpenAI Investment Amid AI Funding Race  Australian Scandium Project Backed by Richard Friedland Poised to Support U.S. Critical Minerals Stockpile

Australian Scandium Project Backed by Richard Friedland Poised to Support U.S. Critical Minerals Stockpile  Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies

Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies  Anthropic Eyes $350 Billion Valuation as AI Funding and Share Sale Accelerate

Anthropic Eyes $350 Billion Valuation as AI Funding and Share Sale Accelerate  SoftBank and Intel Partner to Develop Next-Generation Memory Chips for AI Data Centers

SoftBank and Intel Partner to Develop Next-Generation Memory Chips for AI Data Centers  Nvidia’s $100 Billion OpenAI Investment Faces Internal Doubts, Report Says

Nvidia’s $100 Billion OpenAI Investment Faces Internal Doubts, Report Says  SpaceX Reports $8 Billion Profit as IPO Plans and Starlink Growth Fuel Valuation Buzz

SpaceX Reports $8 Billion Profit as IPO Plans and Starlink Growth Fuel Valuation Buzz  Sam Altman Reaffirms OpenAI’s Long-Term Commitment to NVIDIA Amid Chip Report

Sam Altman Reaffirms OpenAI’s Long-Term Commitment to NVIDIA Amid Chip Report  Ford and Geely Explore Strategic Manufacturing Partnership in Europe

Ford and Geely Explore Strategic Manufacturing Partnership in Europe