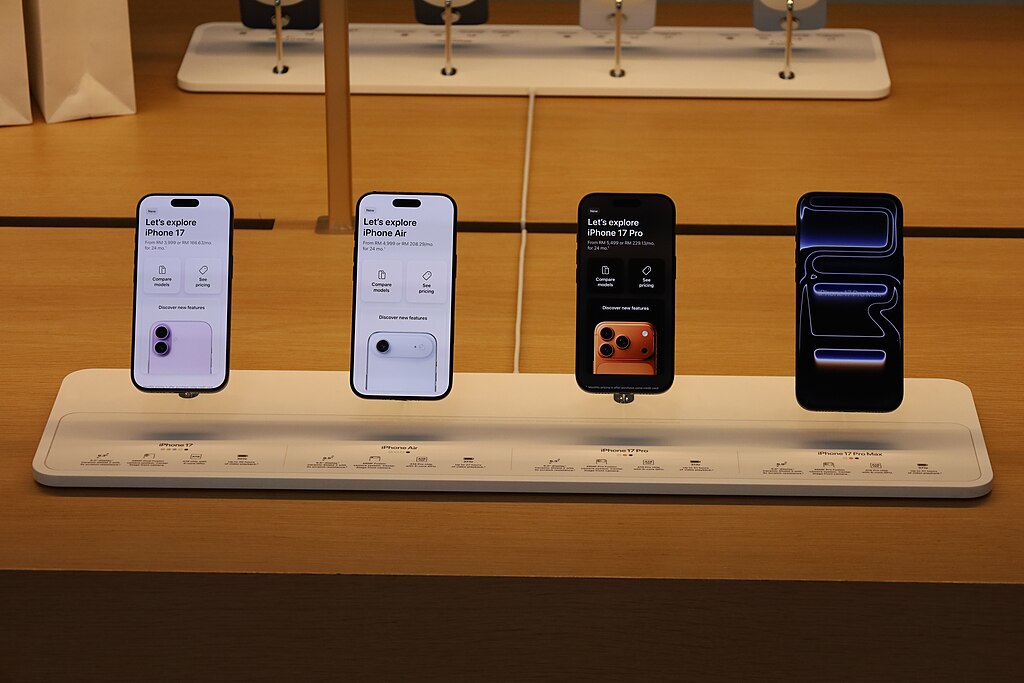

Apple (NASDAQ: AAPL) emerged as the clear winner in China’s Singles’ Day smartphone market, driving a rare 3% year-on-year increase in overall sales despite a challenging environment for most domestic manufacturers. According to new data from Counterpoint Research, robust demand for the iPhone 17 series fueled Apple’s strong performance, putting the company ahead of local rivals still facing cautious consumer spending.

Counterpoint reported that the standard iPhone 17 model generated the highest momentum, boosted by expanded storage options, upgraded camera capabilities, and advanced sensors—while maintaining last year’s pricing. These enhancements helped Apple outperform expectations, particularly in a market where shoppers have grown more selective. Strategic promotions, including discounts of about 300 yuan on the Pro lineup, further accelerated sales. Analysts noted that shipments of the base iPhone 17 more than doubled, while the Pro and Pro Max models registered strong mid- to high-double-digit growth.

However, excluding Apple, Singles’ Day smartphone sales dropped 5% from a year earlier, underscoring subdued consumer sentiment as the fourth quarter begins. Counterpoint highlighted that many customers had already upgraded earlier in the year through subsidy programs, reducing the pool of potential Singles’ Day buyers. Meanwhile, major smartphone brands shifted their focus to newly launched premium devices, raising average selling prices but putting downward pressure on unit volumes.

Among domestic brands, Huawei recorded the sharpest decline as its flagship Mate 80 series missed the crucial sales window by two weeks. Xiaomi (HK: 1810) also saw an 11% year-on-year drop in sales, with its Xiaomi 17 series hitting the market too early to capitalize on November’s peak shopping period.

Apple’s dominance this Singles’ Day underscores its continued strength in China’s premium smartphone segment and highlights how strategic pricing, timely product launches, and meaningful upgrades can shift market momentum even in a cautious economic climate.

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate  Instagram Outage Disrupts Thousands of U.S. Users

Instagram Outage Disrupts Thousands of U.S. Users  Ford and Geely Explore Strategic Manufacturing Partnership in Europe

Ford and Geely Explore Strategic Manufacturing Partnership in Europe  Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million

Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million  Washington Post Publisher Will Lewis Steps Down After Layoffs

Washington Post Publisher Will Lewis Steps Down After Layoffs  SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates

SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates  SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off  Weight-Loss Drug Ads Take Over the Super Bowl as Pharma Embraces Direct-to-Consumer Marketing

Weight-Loss Drug Ads Take Over the Super Bowl as Pharma Embraces Direct-to-Consumer Marketing  Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links  Oracle Plans $45–$50 Billion Funding Push in 2026 to Expand Cloud and AI Infrastructure

Oracle Plans $45–$50 Billion Funding Push in 2026 to Expand Cloud and AI Infrastructure  AMD Shares Slide Despite Earnings Beat as Cautious Revenue Outlook Weighs on Stock

AMD Shares Slide Despite Earnings Beat as Cautious Revenue Outlook Weighs on Stock  TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment  SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO

SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO  SpaceX Updates Starlink Privacy Policy to Allow AI Training as xAI Merger Talks and IPO Loom

SpaceX Updates Starlink Privacy Policy to Allow AI Training as xAI Merger Talks and IPO Loom  TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans

TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans  Anthropic Eyes $350 Billion Valuation as AI Funding and Share Sale Accelerate

Anthropic Eyes $350 Billion Valuation as AI Funding and Share Sale Accelerate  FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns

FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns