Chinese humanoid robot maker AgiBot is preparing for a major initial public offering (IPO) in Hong Kong next year, targeting a valuation between HK$40 billion and HK$50 billion (approximately $5.14–$6.4 billion), according to insider sources. The Shanghai-based startup, founded in 2023 by ex-Huawei engineers Deng Taihua and Peng Zhihui, has quickly risen to prominence amid China’s push to expand its robotics and automation capabilities.

AgiBot has appointed China International Capital Corp (CICC) and CITIC Securities as lead underwriters, with Morgan Stanley joining the effort recently. The firm aims to file a preliminary prospectus early next year and potentially list publicly by the third quarter of 2026, sources said. The IPO could involve the issuance of 15%–25% of its shares, though final details are still subject to change. As of March, PitchBook valued the company at $2.07 billion.

The company’s rapid growth has been fueled by strong investor backing, including Tencent, HongShan Capital Group (HSG), LG Electronics, Mirae Asset, BYD, and Hillhouse Investment. In August, AgiBot secured a multi-million yuan partnership with Fulin Precision Engineering, deploying nearly 100 of its Yuanzheng humanoid robots in factory operations.

AgiBot develops humanoid robots and AI-powered data collection tools under its Yuanzheng and Lingxi product lines, focusing on applications in manufacturing, logistics, and service automation. At its Shanghai training center, robots are trained for complex daily tasks like folding clothes, making coffee, and cleaning.

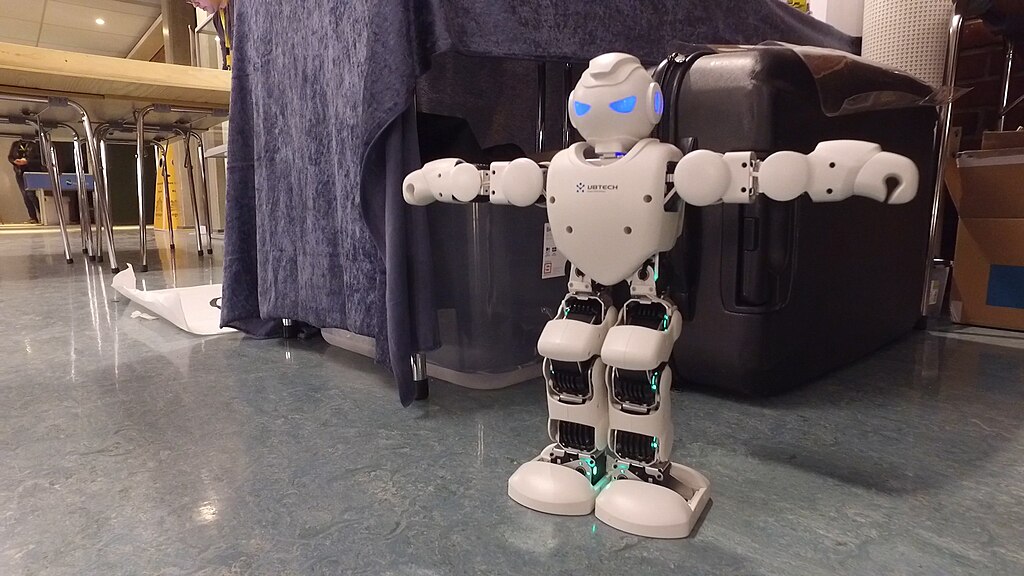

The company gained significant attention earlier this year when President Xi Jinping visited its facilities, showcasing the government’s support for the domestic robotics industry. Its upcoming IPO follows Ubtech Robotics’ 2023 Hong Kong debut, whose stock has surged over 150% this year, and comes as Unitree Robotics plans its own IPO on Shanghai’s STAR Market at a potential 50 billion yuan valuation.

With over 270 IPO filings in Hong Kong this year, the city has reclaimed its status as the world’s leading exchange by combined IPO and secondary listings, raising nearly $24 billion—more than double the total funds raised in 2024.

AgiBot’s planned public offering signals China’s growing ambition to lead the global humanoid robotics race, backed by strong capital, advanced AI integration, and government endorsement.

Ford and Geely Explore Strategic Manufacturing Partnership in Europe

Ford and Geely Explore Strategic Manufacturing Partnership in Europe  Nvidia Confirms Major OpenAI Investment Amid AI Funding Race

Nvidia Confirms Major OpenAI Investment Amid AI Funding Race  Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies

Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies  Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies

Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies  SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO

SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO  SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off  Elon Musk’s SpaceX Acquires xAI in Historic Deal Uniting Space and Artificial Intelligence

Elon Musk’s SpaceX Acquires xAI in Historic Deal Uniting Space and Artificial Intelligence  Instagram Outage Disrupts Thousands of U.S. Users

Instagram Outage Disrupts Thousands of U.S. Users  Anthropic Eyes $350 Billion Valuation as AI Funding and Share Sale Accelerate

Anthropic Eyes $350 Billion Valuation as AI Funding and Share Sale Accelerate  Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026  Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million

Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million  SpaceX Updates Starlink Privacy Policy to Allow AI Training as xAI Merger Talks and IPO Loom

SpaceX Updates Starlink Privacy Policy to Allow AI Training as xAI Merger Talks and IPO Loom  Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape

Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape  Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks

Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks  TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans

TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans  Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine

Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine  TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment