Technical Purview: (USD/JPY)

We cautiously suggest for now fresh short build ups on USD/JPY currency crosses on every upwaves. Both on daily and weekly graphs have started signaling weakness in this pair. So for medium term perspective the pair can test 121.309 levels on the back of Japan evidencing good economic data.

Currently, RSI (14) trending at around 73 levels with upward convergence, on closing basis movement should be closely watched if it suggests reversal signals.

While overbought situation is likely to alarm bears as the slow stochastic noises with %D line cross over above 80 levels (current %D line flashes at 92.3247).

Option trade recommendation:

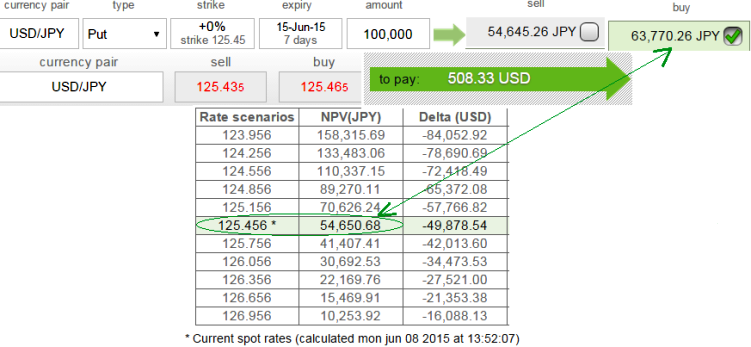

Add longs on protective puts with negative delta, because this is useful to monitor directional risk so you may know how much your option's value will increase or diminish.

Contract carrying option premiums 20-25% above NPV is not to be bought and stay away from such instruments.

Hence, use ATM puts (strike at 125.46) as means for this medium term hedging idea since it carries around 15-16 premiums on option price.

Add protective puts on USD/JPY’s slides

Monday, June 8, 2015 8:31 AM UTC

Editor's Picks

- Market Data

Most Popular

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary