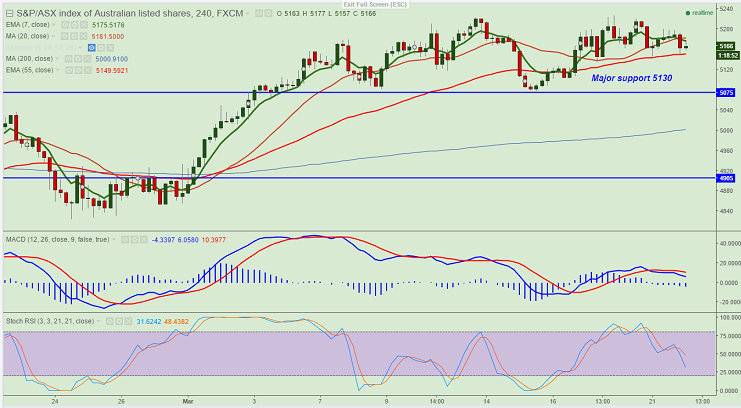

- Major support - 5130

- ASX200 has slightly recovered after making a low of 5151. It is currently trading at 5171.

- Short term trend is slightly bullish as long as support 5130 holds. Any break below 5130 will drag the index down till 5075/5020.

- On the higher side major resistance is around 5205 (200 day MA) and index should close above this level for two consecutive days for further bullishness .Any close above 5205 wil ltake the index till 5225/5275 in short term.

- Short term bullish invalidation only below 4975.

It is good to buy at dips around 5155 with SL around 5130 for the TP of 5205/5225/5275.