Amid a 6% stock decline, Advanced Micro Devices (AMD) champions robust customer interest in its AI-targeted MI300 chip, signaling a potential shakeup in the high-stakes AI semiconductor market, despite certain China-related export challenges.

In extended trading on Tuesday, AMD's stock surged by 4% following the company's announcement of strong customer interest in the upcoming MI300 AI chip, set to launch in the fourth quarter. AMD had announced exciting plans for the fourth quarter as it aims to finish strong with the release of its flagship MI300 AI chips. These chips are set to rival Nvidia's offerings in the rapidly evolving artificial intelligence (AI) semiconductor market. CEO Lisa Su has emphasized the increased production of the MI300 chips and the significant customer interest they have garnered.

AMD has boosted its partnerships with top-tier AI firms, leading cloud providers, and huge firms. The anticipation of releasing the MI300 chips later this year has sparked high investor optimism. These chips are seen as potential rivals to Nvidia in the thriving market for advanced AI chips.

However, there is a significant caveat. The performance of MI300 chips exceeds the limits allowed for sale in China under export controls. Unlike Nvidia and Intel, AMD has yet to develop specialized chips tailored for the lucrative Chinese market.

Despite this obstacle, AMD is actively working on modifying the MI300 and older MI250 chips to comply with U.S. export controls while still meeting the Chinese demand for AI solutions.

While AMD has not provided a detailed full-year forecast, the company expects to surpass the $6.04 billion revenue generated in 2022 from its data center business sales, including the MI300 chips.

According to Jenny Hardy, a GP Bullhound portfolio manager who holds stocks in both Nvidia and AMD, Nvidia's supply constraints open up opportunities for AMD's chips. Hardy emphasizes that if AMD can effectively increase production and successfully launch the MI300 chips in the fourth quarter, there will likely be substantial demand due to the scarcity of Nvidia chips.

To assure stakeholders, AMD emphasizes that it has ample components for the MI300 chips to support an "aggressive" launch in the fourth quarter and sufficient supply for 2024. Furthermore, analysts predict a rise in data center spending by major cloud players like Microsoft and Google, focusing on AI chips and infrastructure in the latter half of the year.

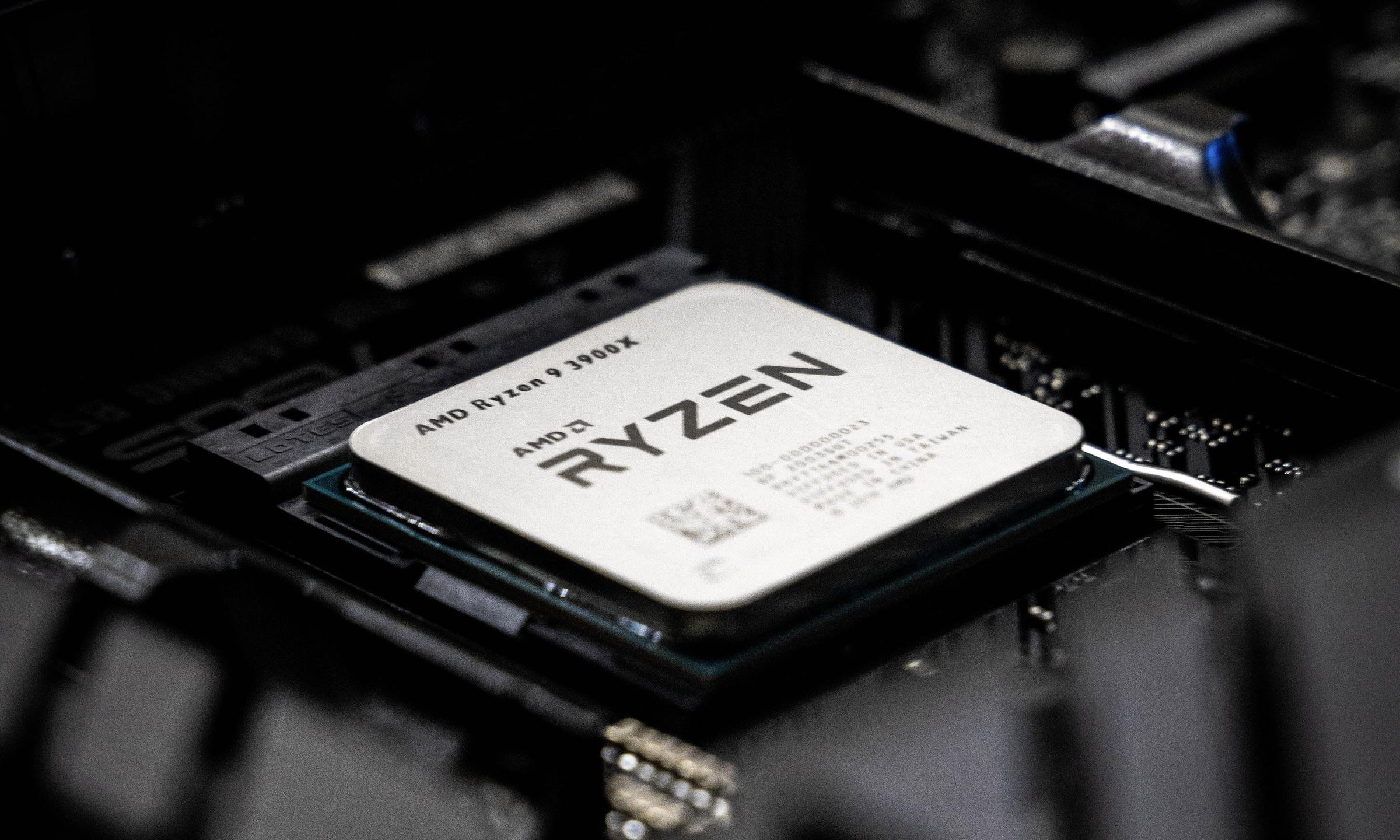

Additionally, AMD's finance chief Jean Hu expects the company's data center and client segment revenues to witness double-digit sequential growth in the third quarter. This growth is driven by increased demand for their EPYC and Ryzen processors.

With these developments, AMD is poised to significantly impact the AI semiconductor market, challenging Nvidia's dominance and capturing the interest of investors and industry players alike.

Photo: Tomáš Malík/Unsplash

SpaceX Reports $8 Billion Profit as IPO Plans and Starlink Growth Fuel Valuation Buzz

SpaceX Reports $8 Billion Profit as IPO Plans and Starlink Growth Fuel Valuation Buzz  Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million

Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million  SpaceX Updates Starlink Privacy Policy to Allow AI Training as xAI Merger Talks and IPO Loom

SpaceX Updates Starlink Privacy Policy to Allow AI Training as xAI Merger Talks and IPO Loom  Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised  Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies

Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies  OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering

OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch

Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch  Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine

Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine  Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks

Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks