ADP employment data to be released at 12:15 GMT is today’s most vital dockets from the US to be watched by market participants. This report is one of the key data that investors will use to gauge US economic strength.

What is ADP employment?

- The report is a measure of non-farm private sector employment which is obtained by utilizing an anonymous subset of roughly 400,000 U.S. businesses which are clients of ADP.

- This data is a very good measure of employment strength of the economy and a good precursor of Nonfarm payroll data.

Past performance –

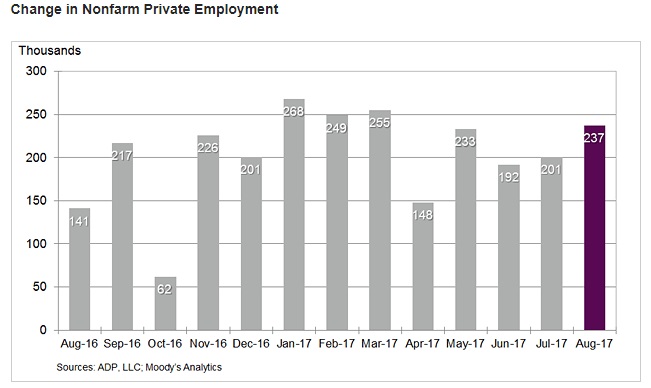

- Non-farm private sector employment grew at 237,000 in August. In July payroll grew by 178,000.

- Small business sector hiring at 48,000 in August.

- Midsized companies added 74,000 jobs.

- Large companies added 115,000 jobs in August.

- Employment in franchise increased by 21,200.

- 16,000 jobs added in the manufacturing sector.

- 1,000 jobs were lost in the natural resources and mining sector.

- 33,000 jobs were added in the goods-producing sector.

- Construction sector added 18,000 jobs.

- Leisure and hospitality sector added 51,000 jobs.

- 11,000 jobs were added in financial activities.

- Services sector remains the major job provider. Payroll added 204,000 people in August.

Expectation Today –

- The headline number is expected to increase to 125,000 as per median estimate.

Market Impact –

- Any gain above 200,000 will be considered to be very good and the US stock market would rise further on risk-affinity, along with a recovery in the dollar. The dollar index is currently trading at 92.36, down 0.3 percent for the day so far.

- Data below 120,000 likely to give rise to concerns regarding US economic prowess and doubts would emerge on manufacturing revival under Trump.

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Oil Prices Slip as U.S.–Iran Talks Ease Supply Disruption Fears

Oil Prices Slip as U.S.–Iran Talks Ease Supply Disruption Fears  U.S. Stock Futures Edge Higher as Tech Rout Deepens on AI Concerns and Earnings

U.S. Stock Futures Edge Higher as Tech Rout Deepens on AI Concerns and Earnings  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Australia’s December Trade Surplus Expands but Falls Short of Expectations

Australia’s December Trade Surplus Expands but Falls Short of Expectations