ADP employment data to be released at 12:15 GMT is today’s most vital dockets from the US to be watched by market participants. This report is one of the key data that investors will use to gauge US economic strength before the next FOMC meeting announcement on September 21st.

What is ADP employment?

- The report is a measure of non-farm private sector employment which is obtained by utilizing an anonymous subset of roughly 400,000 U.S. businesses which are clients of ADP.

- This data is a very good measure of employment strength of the economy and a good precursor of Nonfarm payroll data.

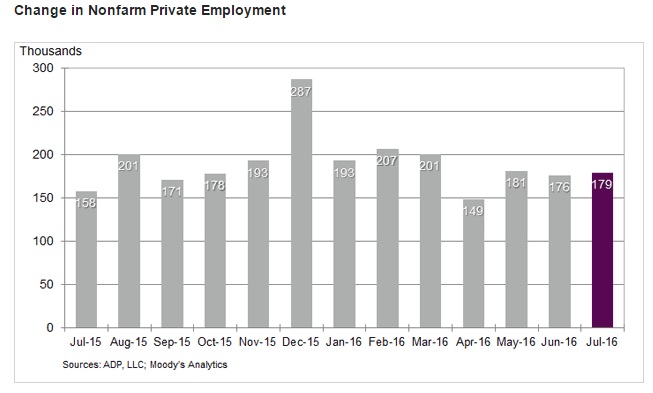

Previous performance –

- Non-farm private sector employment grew at 179,000 in July. In June payroll grew by 176,000.

- Small business sector hiring at 61,000.

- Employment in franchise increased by 21,200.

- 4,000 jobs were added in the manufacturing sector.

- 6,000 jobs were lost in the goods-producing sector.

- The construction sector lost 6,000 jobs.

- 11,000 jobs were added in financial activities.

- Services sector remains job provider. Payroll added 185,000 people in July.

Expectation Today –

- Headline number is expected to marginally decline to 175,000 as per median estimate.

Market Impact –

- Any gain above 200,000 will be considered to be very good and rate hike bets are likely to rise once more, providing support to the dollar.

- Data below 150,000 likely to give rise to concerns regarding US economic prowess and investors would have to consider their rate hike outlook, and there could be a run towards safety.

The dollar index is currently trading at 96.1, up 0.1 percent for the day.

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Australia’s December Trade Surplus Expands but Falls Short of Expectations

Australia’s December Trade Surplus Expands but Falls Short of Expectations  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions