The Bank of England (BoE) meets on Thursday, 4th August to set monetary policy and is likely to become the first central bank to take action in response to the referendum. Amid the heightened uncertainty, expectations are riding high that it will announce a raft of measures to support the economy – including a possible Base Rate cut. BoE will also publish latest inflation report and growth forecasts this week and markets will look closely at the inflation report to see the central bank's take on Brexit consequences.

At its previous rate-setting meeting, the Monetary Policy Committee (MPC) had put on hold the rate cut decision in the aftermath of the Brexit vote and was awaiting more data. However, the committee has dropped heavy hints that it will act this week when fresh forecasts for the economy are published. The Reuters consensus suggests that the BOE will cut the bank rate by 25 basis points, to 0.25 percent, when it announces its decision at noon on Thursday.

Also, the Bank’s forecasts are expected to include a major downgrade to the prospects for the British economy. Expectations are for the BoE to slash the growth forecast of the economy for 2016 to less than 1 percent from the 2.3 percent projected in May. The downgrade would be the largest since 1997. Expectations are also high that the Bank will expand the quantitative easing (QE) program whereby it will create electronic cash to buy bonds and add money into the financial system.

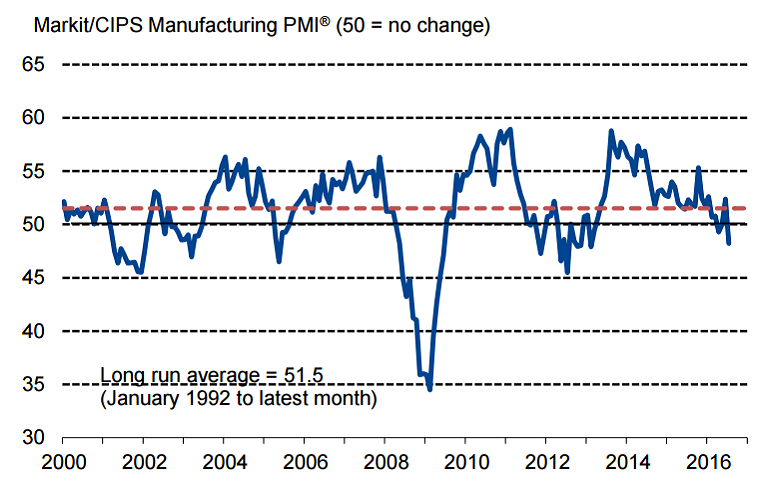

The CBI said last week that retail sales were falling at their fastest rate since early 2012, while figures from IHS Markit’s Purchasing Managers’ Index (PMI) showed a fall to 47.7 in July - the lowest level since April in 2009. Earlier today, Markit/CIPS UK Manufacturing PMI surprised the markets to the downside, fell to lowest level since early 2013. UK construction and services numbers which are due for release on Tuesday and Wednesday will be the last set of data ahead of the policy decision on Thursday.

"On that score, the weak numbers provide powerful arguments for swift policy action to avert the downturn becoming more embedded and help to hopefully play a part in restoring confidence and driving a swift recovery," said Rob Dobson, senior economist at Markit.

The overnight index swap (OIS) market attaches a 100 percent probability for some sort of rate cut on Thursday. Interestingly, that breaks down as a 95.3 percent chance of a 25 basis points cut and a 4.7 percent chance of a 50 basis points cut.

"We see little reason for the Bank of England to restrict itself to a 25 basis point rate cut in August, in terms of both the need for a larger policy response and the Bank of England’s ability to deliver one,” said Allan Monks, economist at JP Morgan.

The pound was trading at 1.3170, down 0.39 percent on the day at 10:45 GMT. EUR/GBP was up 0.44 percent at 0.8474. The UK gilts plunged on Monday as investors did not react to the weak manufacturing PMI data. The yield on the benchmark 10-year gilts rose nearly 2 basis points to 0.705 percent, the yield on super-long 40-year bond also jumped 2 basis points to 1.421 percent and the yield on short-term 2-year bonds bounced 3 basis points to 0.144 percent by 10:30 GMT.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand