The recent messages of Carney of BoE are set to provide GBP volatility a boost as the market waits to see whether members of the MPC reckon that it is going to be fair enough to allow for higher interest rates in the UK. As many as 3 of the 9 committee members could vote for a hike. We’ve mentioned in earlier posts stating that Fed’s rate hike expectation receives a large spread via volatility swaps.

EUR/USD volatility has limited room to increase from current levels as the market already discounts a disorderly fall and Greece issues have been settled temporarily. But on the back of it, after insider trading in stocks, bonds and commodities, it is now the interest rate’s turn “price rigging in benchmark interest rate (LIBOR)”. The manipulation by former UBS Group AG and Citigroup Inc. trader Tom Hayes in Libor, the first person to stand trial for manipulating Libor, was found guilty of conspiracy to rig the benchmark rate.

Prosecutors said during the nine-week trial that Hayes was the “ringmaster” of a global network of 25 traders and brokers from at least 10 firms who tried to manipulate Libor on an industrial scale. The UK jury found that the 35 year old involved conspiring with the traders and brokers to dishonestly game the London interbank offered rate to benefit his own trading positions. In this scam, he would audaciously bribe, torment, persuade and reward his contacts for their help in skewing the benchmark, used to price more than $350 trillion of financial contracts from mortgages to credit cards and study loans.

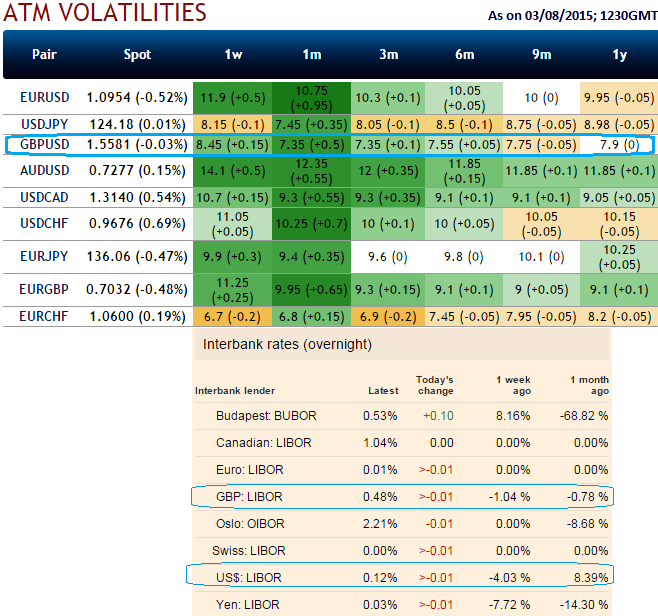

Since currency swaps are motivated by competitive advantage when we you look at the volatility difference of the ATM contracts in the above nutshell one can make out the cable’s vols would be on lower side over next 6 months or 1 year, hence we recommend trading the spreads on the 6M tenor.

“Hayer being guilty of LIBOR rigging”, Fed’s rate hike hopes and IV concerns to fuel disruption in GBP/USD rallies

Monday, August 3, 2015 3:15 PM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate