Despite the gains in GBPUSD from last two days, we suggest not to get bull trapped.

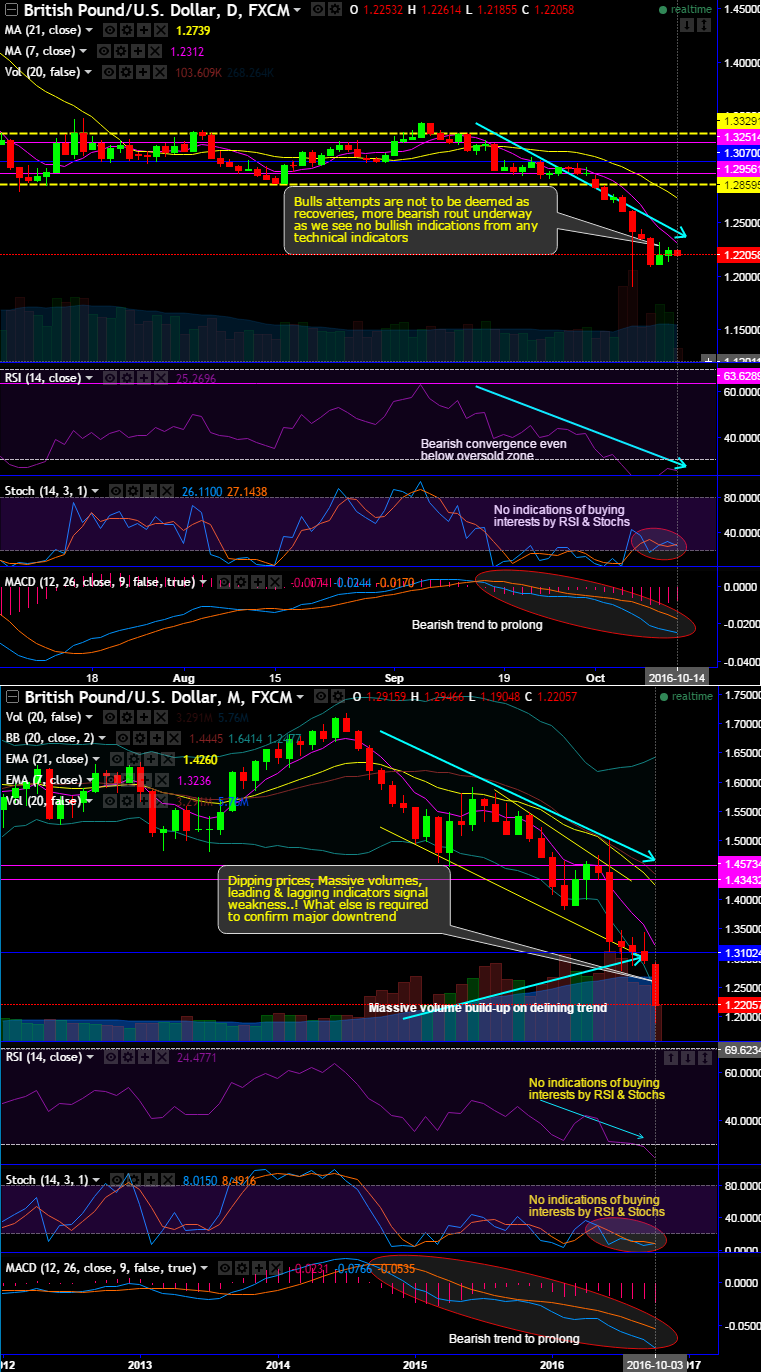

Bears may resume at any time with attempts of sliding further as the current prices have remained well below 7DMA in spite of two days of rallies (see daily charts).

Today again opened at 1.2253 and tried stretching up to day highs of 1.2261 but upswings haven’t been able to sustain and slid below to the current 1.2198 levels (while articulating).

RSI & Stoch are indicative of further dips on both daily and monthly charts, while the current prices on these timeframes are well below EMAs.

RSI: Currently, RSI (14) on daily charts has been converging downwards.

Stochastic: Slow stochastic noises with the attempts of %D line cross over near overbought region, which means that it alarms bears trying to take over the tight rallies.

On long-term perspectives, dipping prices, Massive volumes, leading & lagging indicators signal weakness..! What else is required to confirm major downtrend?

Monthly MACD’s bearish crossover continued to move below zero level which is bearish region.

Hence, contemplating above technical reasoning, although it seems like short-term buying opportunity, we would still foresee further GBP weakness in medium terms on BoE's further rate cut expectations are intensified and recent alerts of the economic risks due to the details of Brexit implementation and Article 50 activation has been announced and likely to be implemented latest by Q1’2017.

For intraday trading perspective, it is advisable to buy boundary binaries on dips upper strikes at 1.2312 and lower strikes at 1.2127.