The Japanese government bonds strengthened Wednesday after the Bank of Japan (BoJ) in its daily bond buying operations purchased more of super-long bonds to keep yields curve towards the central bank’s target range. Also, investors poured into safe-having assets after energy oil prices fell following a rise in U.S. crude inventories.

The benchmark 10-year bond yield, which moves inversely to its price, fell 3 basis points to 0.05 percent, the long-term 30-year bond yield dipped 5 basis points to 0.75 percent and the yield on short-term 2-year note slid 1-1/2 basis points to -0.19 percent by 06:30 GMT.

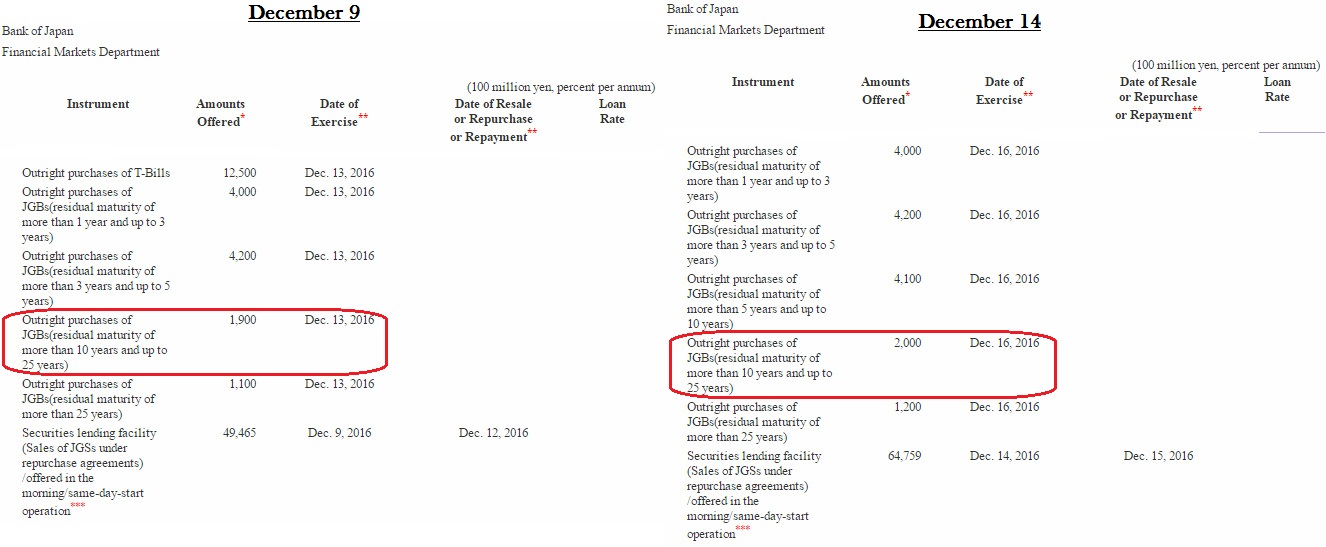

Today, the BoJ in its daily bond-buying operations purchased more of super-long bonds as compared to 190 billion yen on December 9. It purchased 120 billion yen of JGBs with over 25 years left to maturity. It also offered to buy 200 billion yen of JGBs with between 10 and 25 years left to maturity.

Moreover, the JGBs have been closely following developments in oil markets because of their impact on inflation expectations, which are well below the Bank of Japan's target. Crude oil prices declined as investors cashed in profits after U.S. inventories rose by 4.68 million barrels last week; the industry-funded American Petroleum Institute was said to report. The International benchmark Brent futures fell 1.26 percent to $55.02 and West Texas Intermediate (WTI) dipped 1.30 percent to $52.29 by 05:00 GMT.

Markets will remain focused on the Federal Reserve last monetary policy decision for 2016, which is scheduled to be released on December 14. The Federal Reserve is expected to increase the target range of the key interest rate by 25 basis points to 0.50-0.75 percent, with a unanimous decision. Little change to the statement, though the Committee is likely to acknowledge that market-based measures of inflation compensation have risen further.

Meanwhile, the benchmark Nikkei 225 closed nearly flat at 19,253.61. While at 07:00 GMT, the FxWirePro's Hourly Japanese Yen Strength Index remained slightly bearish at -96.81 (lower than -75 represents bearish trend).