Several post-referendum inflation reading will be published today by National Statistics (ONS) that need to be monitored closely to assess the first knee jerk reaction to prices due to the referendum. At one hand, deteriorating consumer sentiment is likely to exert pressure on the downside, whereas the sharp drop in sterling could provide a sudden push upwards, especially to the input cost of the producers.

Let’s review the price indices that would be released today-

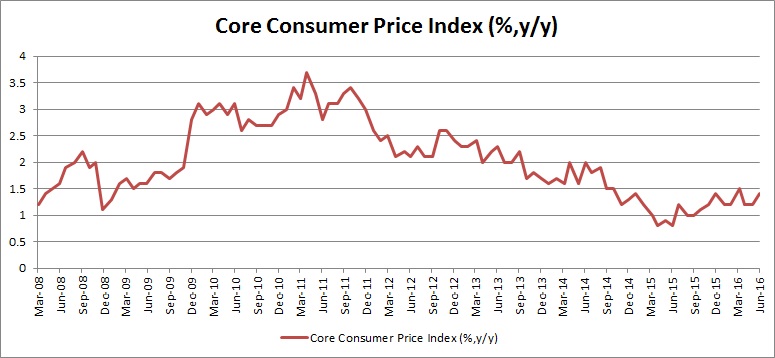

- Core consumer price index: After bottoming in June last year, core consumer prices (C-CPI) has crept higher, however, it has consistently failed to grow faster than 1.5 percent. However, there is a possibility that the downtrend that saw C-CPI growth decline from 3.6 percent in 2011 to below 1 percent in early last year is over.

- Producer price index (input): This should be closely watched today as the weaker pound is expected to hit this component the hardest and there could be a spike. Even the market is expecting 2 percent y/y growth in July, compared to -0.5 percent in June. It has been broadly in the negative territory since late 2013. In recent days, however, it has been creeping higher.

- Producer price index (output): As input costs declined over the last few years, producers have been passing the benefits to consumers to spark higher demand. Like other indices, it has also been creeping higher in recent days but the pace of reversal has been very weak so far.

- House price index: House prices have been soaring in the United Kingdom since the 2008/09 crisis. The price growth has somewhat slowed since the oil price crash but still strong. Other housing market indicators are suggesting that the house prices will drop in July and growth will slow down on a yearly basis.

- Retail price index: There could be a marked slowdown in RPI as the consumer sentiment deteriorated after the referendum.

The most vital would be to watch out the sterling’s and rate markets’ reaction to the data, especially whether the rate cut bets remain despite higher inflation or not. Sterling is currently trading at 1.292 against the dollar.

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off