Abe needs to persuade Trump next week as the US president Trump mentioned during a meeting with pharmaceutical company executives in last week that “They [China and Japan] play the devaluation market.”

In a press conference, BoJ governor Kuroda responded that the BoJ’s aggressive easing, the first arrow of Abenomics, is not intended to devalue the yen. The official view from the BoJ and the government is that Japan’s monetary policy is targeting neither the level of JPY nor stability of the currency market, as stated. Prime Minister Abe also emphasized this point in the Diet session.

However, they must certainly remember the political pressure from the US that led to the rapid JPY appreciation in the early 1990s (see our FX research team’s “Japan-U.S. trade frictions and the yen, Lessons from the early 1990s”).

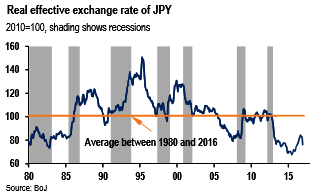

We note that the real effective JPY exchange rate was not a slow then as it is now (see above chart). This means that the US may have more grounds for the statement now, though what the US government would do is uncertain. Abe will visit Trump next Friday with the minister of finance, who is in charge of currency policy.

They probably will attempt to persuade the administration that Japan is not a currency manipulator and is in fact contributing to US job creation through foreign direct investment. Trump’s reaction may cause market volatility, which would raise the risk that business confidence will start to deteriorate.

While BoJ stood on hold as widely anticipated; autopilot likely would continue at least until H2 of this year. The Japanese central bank delivered no surprises at its policy meeting this week, leaving in place the parameters of its yield curve control policy (-0.1% for the IOER and the around -0% target for the 10-year JGB yield) and of asset purchases, including the about ¥80 trillion per year for JGBs. In any event, we think it is still too early to talk about a policy change.

In fact, the BoJ revised up its growth forecast but left the inflation projection unchanged (and very high compared to our and the market consensus forecast), implying that their inflation outlook has become somewhat cautious. More importantly, their risk bias for both growth and inflation skews to the downside. We continue to believe the BoJ will stay on hold at least for the next six months, if not longer.

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal