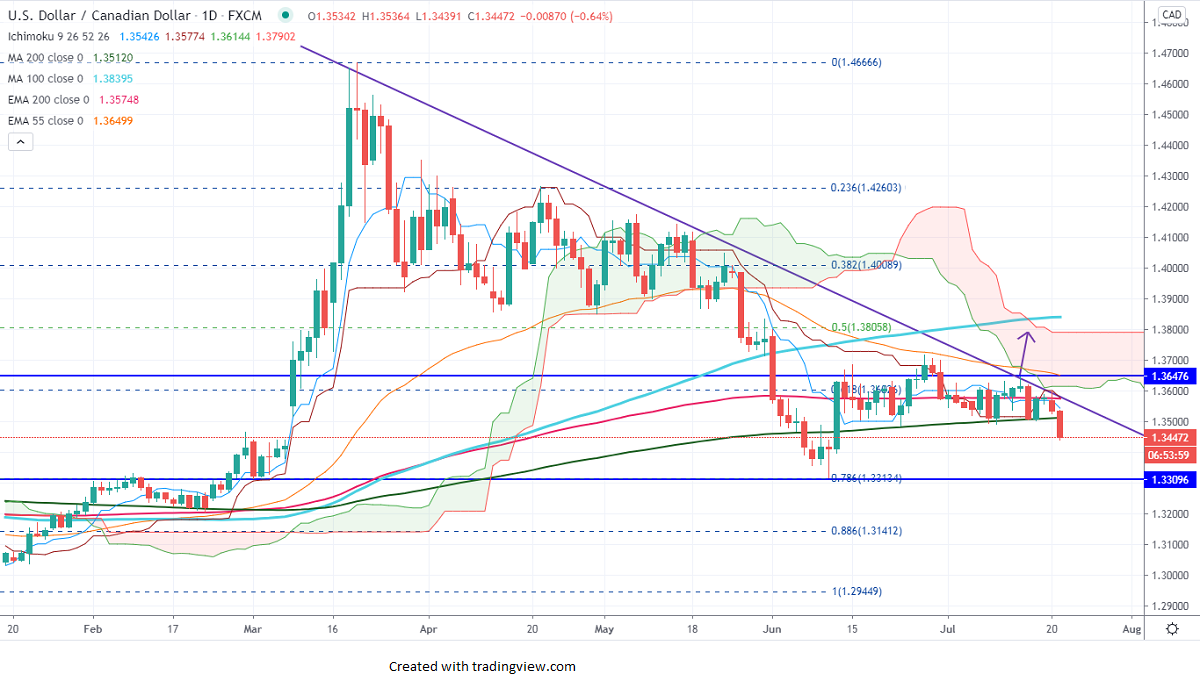

Ichimoku analysis (Daily chart)

Tenken-Sen- 1.35686

Kijun-Sen- 1.3600

USDCAD declined more than 150 pips from a high of 1.36000 on broad-based US dollar selling and the strong crude oil prices. The pair was one of the worst performers in the past three weeks and has lost more than 250 pips from minor top 1.37154.

WTI Crude oil jumped sharply more than $2.5 on COVID-19 optimism. It has broken significant resistance $41.65, a jump till $43.25 likely.

Technically, the pair is holding well below 1.34950 (200-day MA) and it confirms bearish trend continuation. A dip till 1.3380/1.33155 is possible. The near term resistance is at 1.3540, an indicative break beyond will take the pair to the next level till 1.3580/1.3635.

It is good to sell on rallies around 1.3478-80 with SL around 1.3540 for the TP of 1.3320.