Fed’s Forward Guidance: Those looking for explicit guidance from the Fed on the timing of its next move may be disappointed. That said, it’s clear the Fed is conscious of the negative feedback loop that would result from a policy surprise.

At present, the market is pricing about a 20% chance the Fed will hike in June.

If the Fed thinks this probability is too low, then it will need to address this. Prior to the December 2015 hike the Fed said in its October Statement that: “in determining whether it will be appropriate to raise the target range for the fed funds rate at its next meeting”.

Subsequently, Fed rhetoric consistently flagged that a decision on a rate hike in December was being actively considered and was a live possibility.

USD OTC FX observation:

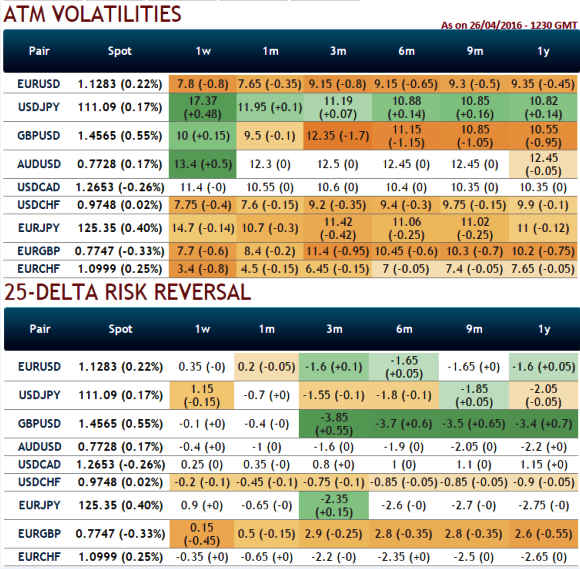

One can easily understand the OTC markets’ positioning of USD against majors. The implied volatilities for 1M – 1Y tenors have been reduced except USDJPY pair, and it is neutral in case of AUDUSD and USDCAD.

This means dollars’ hedging activities majorly considering US central bankers dovish tone have been reducing or adequate FX risk management is in place.

But the dollar continues to lose against Yen as per the delta risk reversal computations, these numbers are progressively increasing up with extremely negative sentiments.

We now reiterate OTC set up signifies the hedging sentiments are well equipped for downside risks over the period of time.

DXY that measures the greenback’s strength against a trade-weighted basket of six major currencies among G10 space has decreased to 94.31. The bear trend in this index has been prolonging from last five months or so.

Overnight, the dollar remained broadly lower against the other majors as well on Tuesday, as the release of disappointing U.S. economic reports hampered the demand for the greenback and as long term investors stood vigilant ahead of the Federal Reserve’s policy statement.

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal