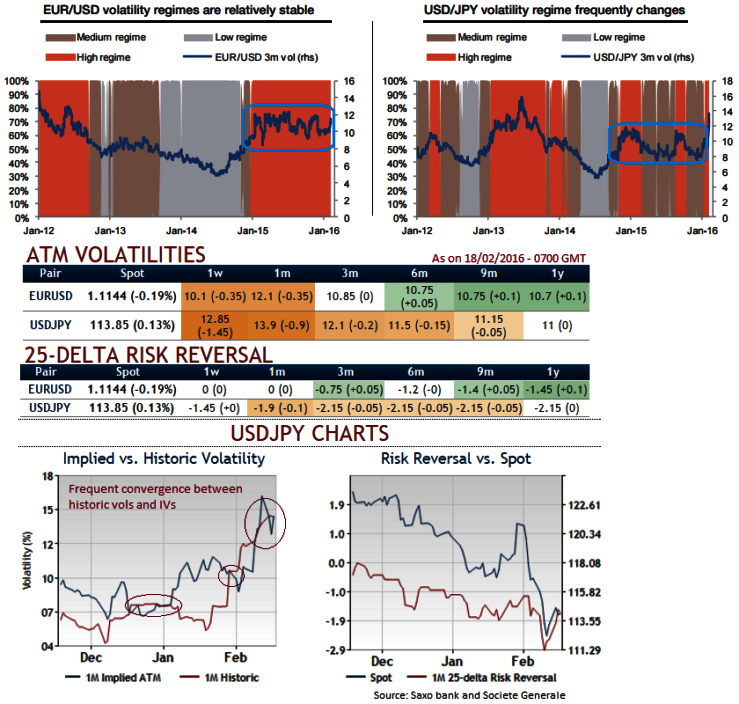

It is keenly observed that USDJPY evidences the frequent convergence between historic vols and IVs from end of January that is when Yellen's 1st monetary policy meeting after last year's rate hike in December.

On the other hand, implied vols for USDJPY is more than that of EURUSD. This spiking IVs in long run in case of USDJPY is justifiable as you can keep an eye on risk reversal numbers. In recent past, we've seen their severe bearish turn in USDJPY spot FX. With current spot FX is flashing at 113.728, it is projected to go below 110 in the near future.

Three regime are generally sufficient to describe volatility states.

As per the Markov Switching model, both EUR/USD and USD/JPY volatility themes are in the high volatility regime.

Nonetheless, grippingly, it switched to that regime at end-2014 in EUR/USD (See 1st graph), while the switch of regimes has been much more erratic in USD/JPY. Amid this volatility switching we saw a massive drop of almost 6.58% in USDJPY from the last month's highs to the current levels of 113.728.

The dearth of persistence in USD/JPY volatility regimes (rapidly flashing between medium and high regimes) shows that USD/JPY volatility of volatility is likely to stay higher than the EUR/USD equivalent.

Beyond the tail risk of a range exit, which recently materialised, it also justifies USD/JPY butterflies being the most expensive.

USD/JPY volatility of volatility to continue to dominate EUR/USD - OTC positioning proves it right - Historic vols converge ATM IVs

Thursday, February 18, 2016 9:32 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand