There should be no doubts among anyone that the ‘trade war’ is real, and it could get infinitely worse before it gets better. With President Trump’s iron resolve on the issue, the only possible outcome is a reduction in U.S. trade deficits with the rest of the world, whether it is achieved through a trade negotiation or by the introduction of more tariffs.

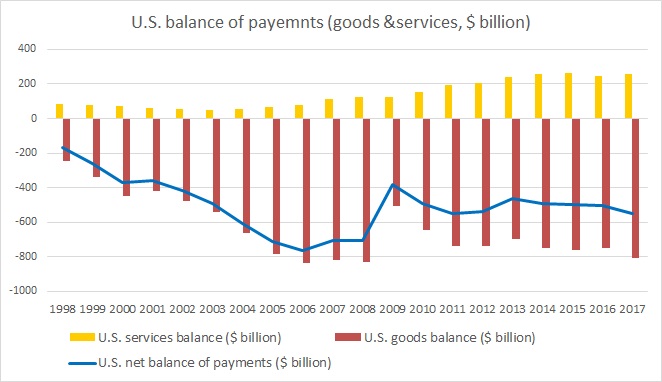

The chart shows the U.S. balance of payments with the rest of the world. According to the data from census bureau show that while the United States enjoyed $255.2 billion trade surplus in services in 2017, it ran a goods trade deficit of $807.49 billion, which gives a significant upper hand to the Trump administration in its negotiations.

Speaking at an event this week, President Trump said that while many people tried to persuade saying that in the globalized world it doesn’t matter where a product is made but stressed that it matters to him that it is produced in the U.S. with American labor.

Moreover, yesterday’s action shows that he is not only prepared for the trade war with all his available tools and he is ready to push it further. Faced with retaliation against U.S. agricultural exports from China, Mexico, and the European Union, President Trump had directed the U.S. Secretary of Agriculture Sonny Prelude to craft a short-term relief strategy targeting agricultural producers of the United States and last night announcement came from the USDA that it would authorize up to $12 billion in programs, which is in line with the estimated $11 billion impact of the unjustified retaliatory tariffs on U.S. agricultural goods.

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed